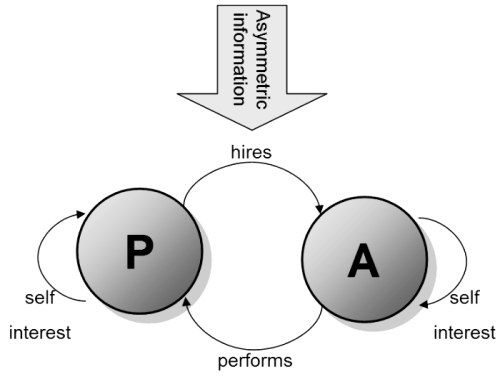

Agency problems in financial management refer to the conflicts of interest that can arise between the owners (i.e., shareholders) of a company and the managers who run the company on their behalf. These conflicts can lead to misaligned incentives and decision-making, resulting in suboptimal outcomes for the company and its shareholders. In this essay, we will explore some of the ways in which these agency problems can be addressed and solved.

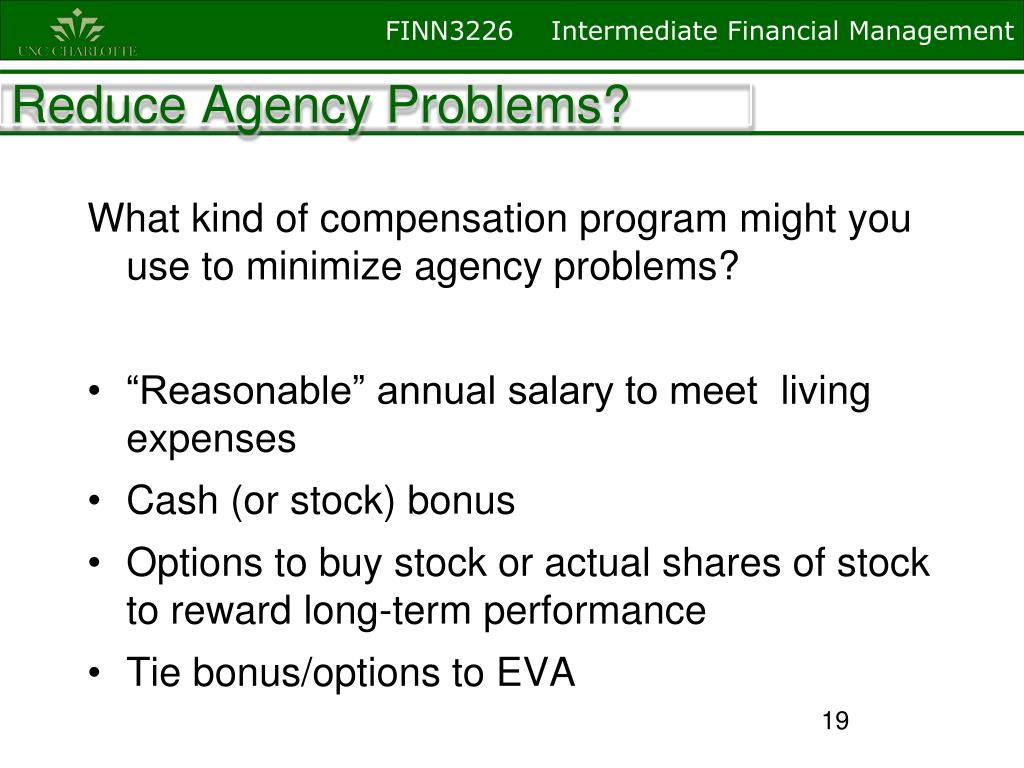

One approach to solving agency problems in financial management is to use mechanisms that align the interests of managers and shareholders. One such mechanism is the use of performance-based compensation, such as stock options or bonuses tied to the company's financial performance. By linking a portion of a manager's compensation to the company's financial performance, it creates an incentive for the manager to make decisions that benefit the company and its shareholders.

Another way to address agency problems is through effective corporate governance structures. This includes having an independent board of directors who are responsible for overseeing management and representing the interests of shareholders. It also includes implementing robust internal controls and checks and balances to ensure that financial reporting is accurate and transparent.

Effective communication between shareholders and management is also crucial in addressing agency problems. This includes providing regular updates on the company's financial performance and strategic direction, and allowing shareholders to have a say in major decisions through voting rights.

Finally, one of the most effective ways to solve agency problems is through the threat of shareholder activism. This can take the form of shareholder resolutions, which are proposals put forth by shareholders that require a vote at the company's annual meeting. Shareholder activism can also involve organized campaigns to push for change at the company, such as through the use of social media or other forms of public pressure.

In summary, agency problems in financial management can be addressed through a combination of performance-based compensation, effective corporate governance structures, effective communication, and shareholder activism. By implementing these measures, it is possible to align the interests of managers and shareholders and ensure that the company is run in a way that benefits all stakeholders.