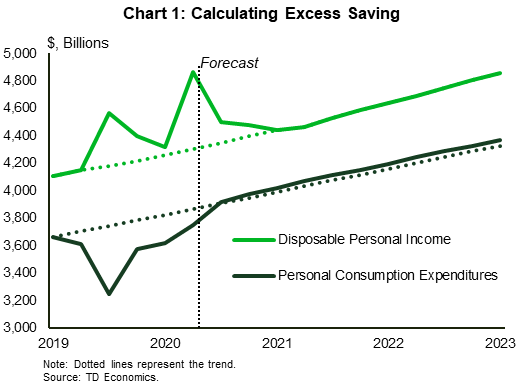

In macroeconomics, savings refers to the portion of an individual or households income that is not spent on consumption but is instead set aside for future use. Calculating savings is important for understanding the financial decisions made by individuals and households, as well as for analyzing the overall economic health of a country.

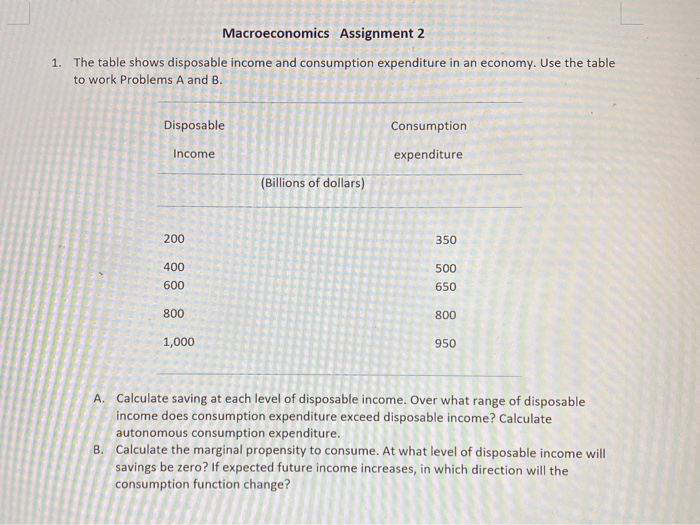

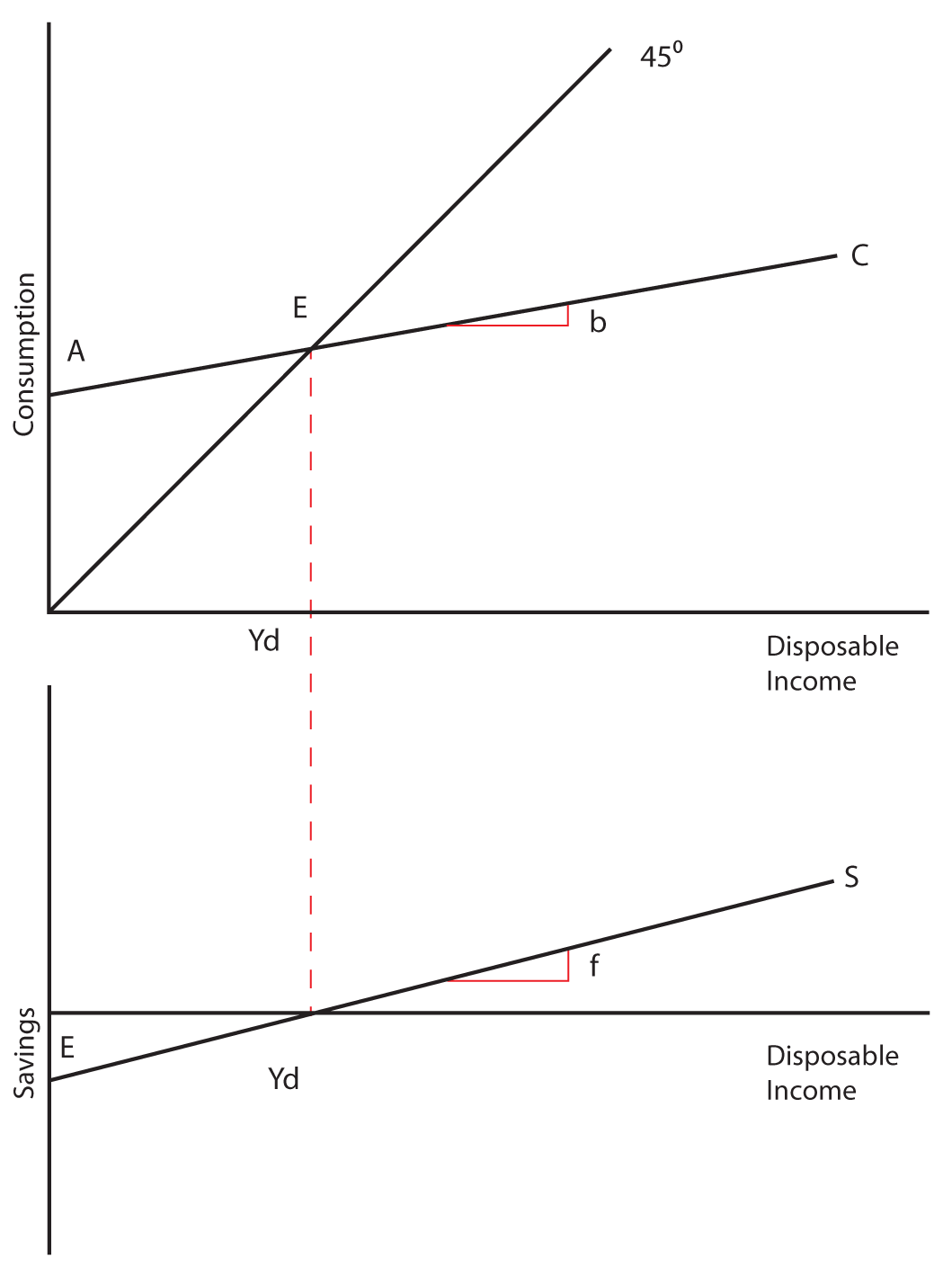

There are several ways to calculate savings in macroeconomics. One common method is to use the savings rate, which is calculated by dividing total savings by total disposable income. Disposable income is the income that is available to an individual or household after taxes and other mandatory deductions have been taken out.

Another way to calculate savings is through the use of national income accounts, which track the income and expenditure of an entire economy. In this case, savings can be calculated as the difference between national income and national expenditure.

It is important to note that savings can take on different forms, such as physical savings in the form of cash or investments, or intangible savings in the form of education or skills development. These different forms of savings can be accounted for in the calculation process by adjusting the definition of savings to include these intangible forms.

There are several factors that can influence the level of savings in an economy. These include the level of disposable income, the level of interest rates, and the level of consumer confidence. A higher level of disposable income and a lower level of interest rates tend to encourage higher levels of savings, while a lower level of disposable income and a higher level of interest rates can discourage saving.

In conclusion, calculating savings in macroeconomics is important for understanding the financial decisions made by individuals and households and for analyzing the overall economic health of a country. It can be done using the savings rate or through the use of national income accounts, and is influenced by a variety of factors such as disposable income, interest rates, and consumer confidence.

What Are Savings? How to Calculate Your Savings Rate

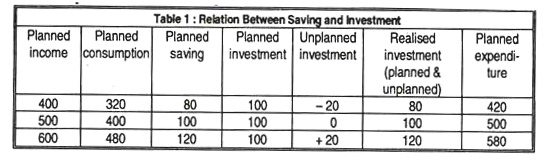

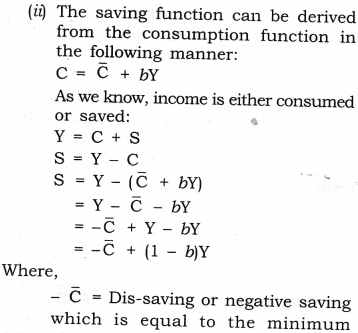

Are they money, too? If taxes are imposed on necessary commodities, people cannot save more. One key message underlying this discussion of M1 and M2 is that money in a modern economy is not just paper bills and coins; instead, money is closely linked to bank accounts. In a Keynesian sense, savings is whatever is left over after income is spent on consumption of goods and services, investment is what is spent on goods and services that are not 'consumed', but are durable. The other is considered to apply to money and banking, the "Monetarist" view. That's what is left out of income after you spend money on consumptions. APS increased from 0.

Macroeconomics/Savings and Investment

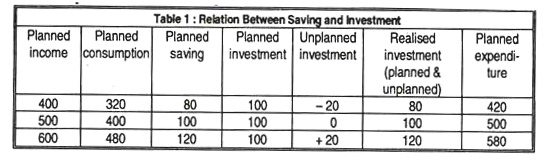

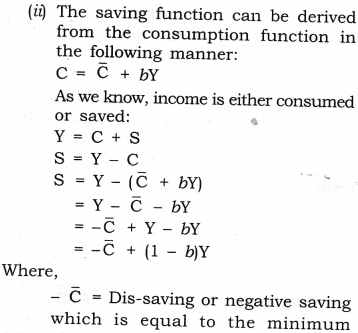

As shown in the table above, we can see that the average propensity in save increases with the increase in income. Level of income Level of income is an important determinant of saving in any economy or country. It is important to note that in our definition of money, it is checkable deposits that are money, not the paper check or the debit card. Since consumption plus saving is equal to disposable income, the increase in disposable income not consumed is saved. People may save for various life goals or aspirations such as retirement, a child's college education, the down payment for a home or car, a vacation, or several other examples. Current household taxes include only taxes on household income and real and personal property taxes and do not include taxes levied on consumption such as sales tax or taxes for Social Security.

Public Savings Calculator

Investment is the rate at which financial intermediaries and others expend on items intended to end up as capital that directly creates value, i. Louis, FRED Economic Data. He is a certified public accountant with experience working for a large New York City accountancy and expertise in areas ranging from private equity taxation to investment management. When the federal government runs a budget deficit, the Reserve Bank of Australia sells government financial securities such as bonds to borrow the money necessary to fund the gap between taxes and spending. M2 includes M1 plus some less liquid but still fairly liquid assets, including savings and time deposits, certificates of deposit, and money market funds.