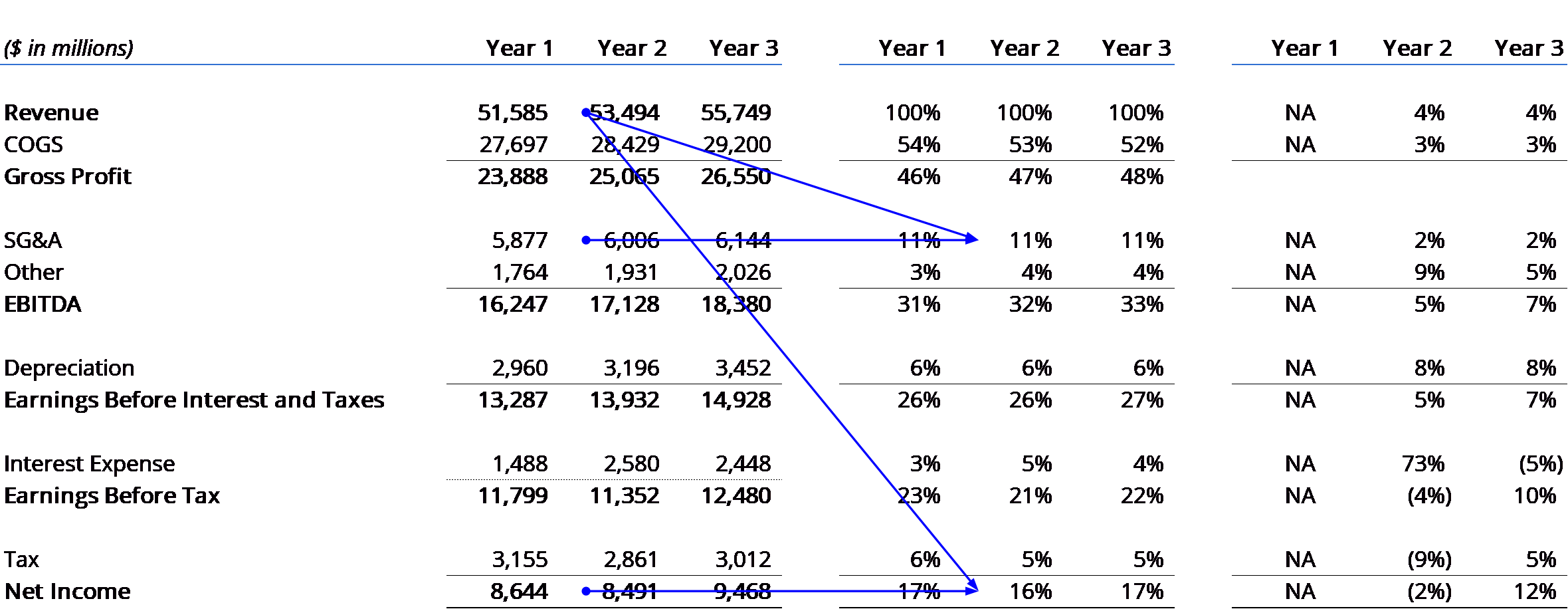

Horizontal analysis, also known as trend analysis, is a technique used to evaluate financial statement data by comparing information for a specific period of time to a previous period. This allows analysts to identify trends and changes in the financial performance and position of a company.

One way to perform horizontal analysis is to express each item in the financial statements as a percentage of a base year. For example, if a company's revenue in 2020 is $100,000 and its revenue in 2021 is $120,000, the change in revenue can be expressed as a 20% increase from the base year of 2020. This makes it easier to compare financial data over time and see how the company has grown or declined.

Horizontal analysis can be used to identify a variety of trends in a company's financial statements. For example, it can be used to analyze changes in revenue, expenses, assets, and liabilities over time. It can also be used to identify trends in key financial ratios, such as the debt-to-equity ratio or the return on assets.

One benefit of horizontal analysis is that it allows analysts to focus on changes within the company rather than comparing the company to industry benchmarks or other companies. This can provide a more comprehensive view of the company's financial performance and help analysts identify areas of strength and weakness.

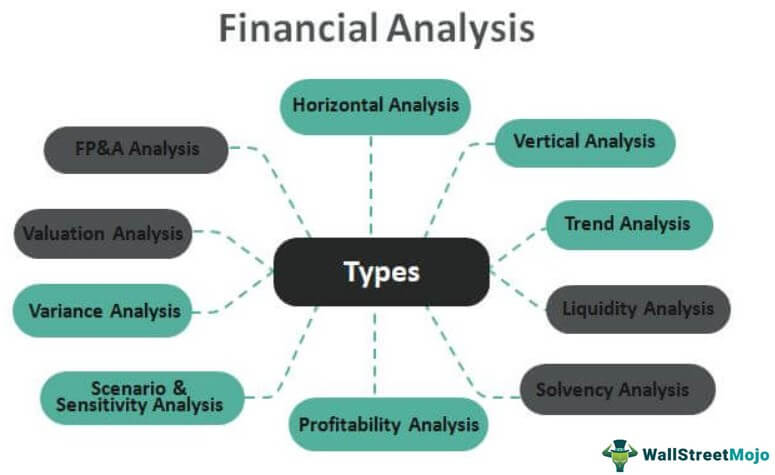

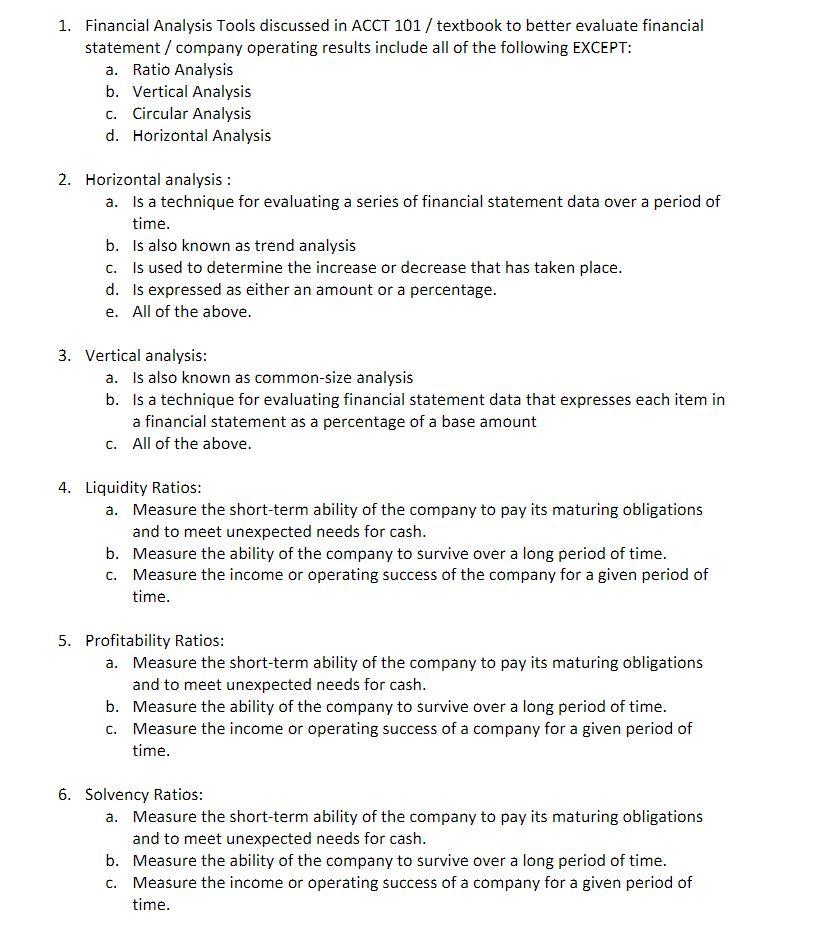

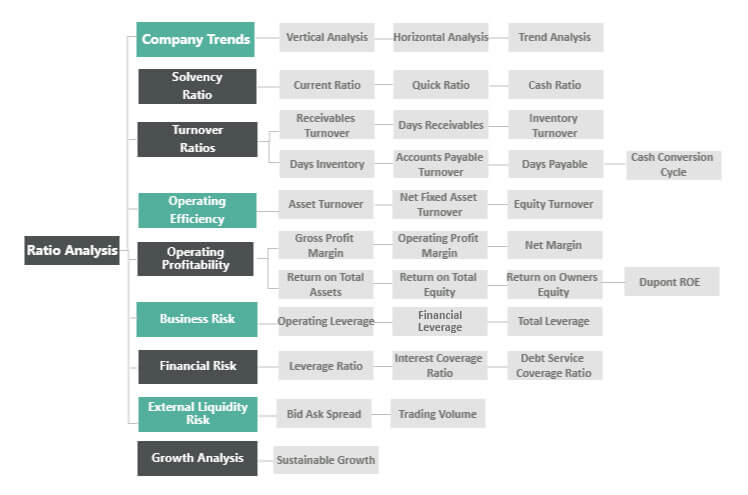

However, it is important to keep in mind that horizontal analysis should be used in conjunction with other techniques, such as vertical analysis and ratio analysis, to get a complete picture of a company's financial health. It is also important to consider any non-financial factors that may have affected the company's financial performance, such as changes in the economy or industry conditions.

In conclusion, horizontal analysis is a useful technique for evaluating financial statement data by comparing information over time. It can help analysts identify trends and changes in a company's financial performance and position, but it should be used in conjunction with other techniques and considerations of non-financial factors.

:max_bytes(150000):strip_icc()/Vertical_analysis_final-5a1448af9904473f97b5438ad4bd17fd.png)