Hard currencies and soft currencies are terms used to describe the relative strength and stability of different currencies. Hard currencies are those that are widely accepted around the world and are considered to be relatively stable and reliable. These currencies are typically associated with countries that have strong economies and political systems, and they are often used as a store of value and a medium of exchange in international trade.

On the other hand, soft currencies are those that are not as widely accepted or stable as hard currencies. They may be more prone to fluctuations in value and may not be as reliable as a store of value. Soft currencies are typically associated with countries that have weaker economies or political systems, and they may not be as widely accepted in international trade.

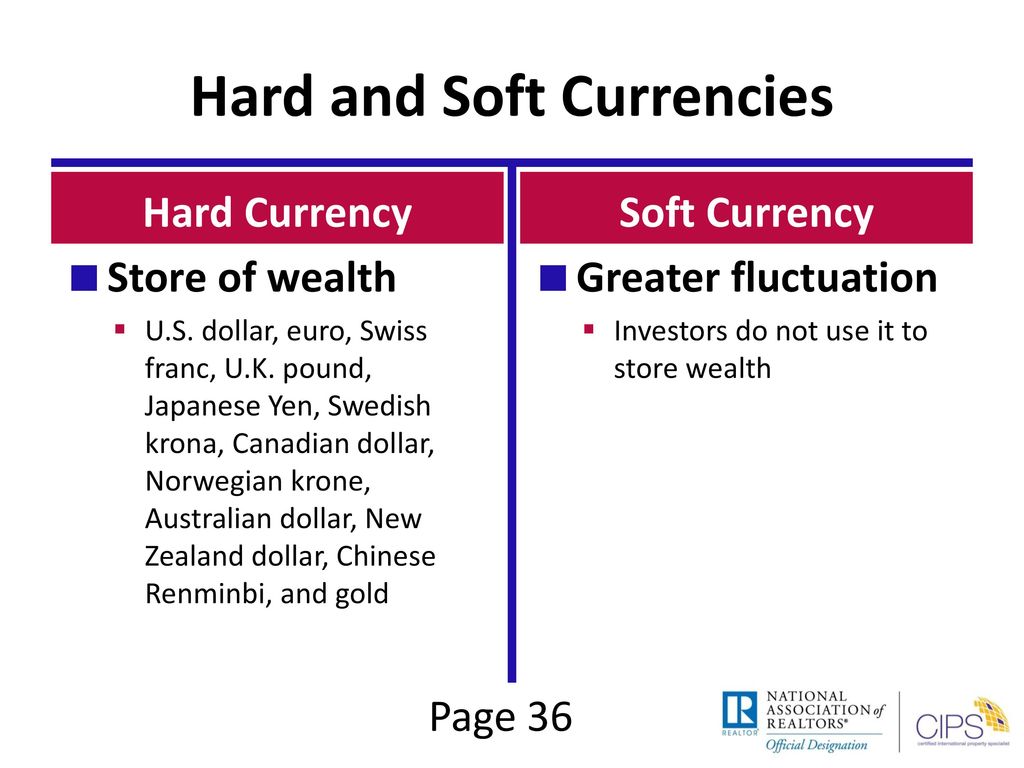

There are a few key characteristics that differentiate hard currencies from soft currencies. One of the most important is the level of acceptance and use around the world. Hard currencies, such as the US dollar, the euro, and the Japanese yen, are widely accepted as a medium of exchange and are used in a variety of international transactions. In contrast, soft currencies may not be accepted as readily in international trade and may be more difficult to exchange for other currencies.

Another key characteristic of hard currencies is their stability. Hard currencies tend to be relatively stable in value, and they are not prone to large fluctuations. This makes them a reliable store of value and a good medium of exchange. Soft currencies, on the other hand, may be more prone to fluctuations in value, which can make them less reliable as a store of value.

Finally, hard currencies are often associated with strong economies and political systems. Countries that have strong economies and well-established political systems are more likely to have hard currencies, as they are seen as more stable and reliable. Soft currencies, on the other hand, may be associated with weaker economies or political systems, which can make them less stable and less reliable.

In summary, hard currencies are those that are widely accepted around the world, are stable in value, and are associated with strong economies and political systems. Soft currencies, on the other hand, are not as widely accepted, may be more prone to fluctuations in value, and may be associated with weaker economies or political systems. Understanding the differences between hard and soft currencies is important for anyone involved in international trade or investing, as it can help them make informed decisions about which currencies to use and how to manage their risks.