The GE Multifactor Portfolio Matrix is a tool used by General Electric (GE) to evaluate and prioritize the various business units within the company. It is a framework that allows GE to allocate resources, including financial and managerial support, to the business units that are most likely to drive growth and create value for the company.

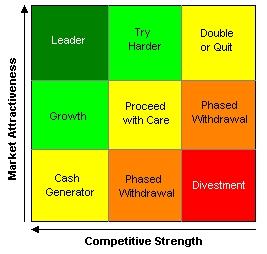

The matrix is based on two key factors: market attractiveness and business unit strength. Market attractiveness refers to the potential for growth and profitability in a particular market, while business unit strength refers to the capabilities and resources of the business unit to succeed in that market.

The matrix consists of four quadrants: stars, cash cows, question marks, and dogs. Stars are business units that have a high market attractiveness and a high business unit strength. These are the most valuable and important business units for GE, as they have the potential to drive significant growth and value for the company.

Cash cows are business units that have a low market attractiveness but a high business unit strength. These business units are not likely to drive significant growth, but they are able to generate a consistent and reliable stream of cash flow for the company.

Question marks are business units that have a high market attractiveness but a low business unit strength. These business units have the potential to be successful, but they also carry a higher risk due to their weaker position in the market. GE may invest resources in these business units in an effort to improve their business unit strength and position them for success.

Dogs are business units that have a low market attractiveness and a low business unit strength. These business units are not likely to drive significant growth or value for the company, and they may be divested or shut down if they are not able to improve their market position.

Using the GE Multifactor Portfolio Matrix allows GE to allocate resources to the business units that are most likely to drive growth and create value, while also identifying areas of weakness that may require additional support or resources. It is an important tool for managing and prioritizing the various business units within the company.

GE McKinsey Matrix (With Examples)

Depending on the outlook of the company, it could either shift to a more attractive industry or strive to improve its competitive position in the current industry. While the GE Matrix helps a marketer in taking product portfolio investment decisions, it has its limitations too! GE Matrix, General Electric Matrix, Nine-box matrix is just like the multiplefactors that are combined to determine the measure of the two variables industry attractiveness and competitive strength. On the other hand, the BCG matrix categorizes products based on their growth potential. Nestle has a long list of products that have been discontinued for whatever reason. Rating 1 symbolizes weak strength and rating 5 or 10 shows superior strength. See the link below. Market segmentation for one SBU that is weighted at 17 and rated at 5, for example, receives a score of 85.

GE McKinsey Matrix EXPLAINED with EXAMPLES

What can we Infer from the GE Matrix? The quarrel for investments can be viewed in every stage of a firm such as among teams, departments, business units, or divisions. In other areas, it competes directly with fellow Nestle drink brand Nesquik. Rather than relying on future projections of business unit, the company can make a systematic decision taking two factors into consideration: the attractiveness of the relevant industry and the competitive strength of the unit within its industry. This basically means that the business unit gets just enough investments or non at all to keep the business running, while reaping the few fruits that may be left. Helps businesses in their growth and acts as an information resource for market opportunities in the future.

[Solved] Q.4. Describe the GE multifactor portfolio matrix and state how the...

Industry attractiveness is demonstrated by how beneficial it is for a company to enter and compete within a certain industry based on the profit potential of that specific industry. But, in this article, I will share with you the science and logic behind why do prices end in 99. It is mainly used to decide which products and business to include in the portfolio and to identify the less profitable products or SBUs needed to be divested. In this case, the question arises of what strategy to adopt for such BUs? In his 6+ years of professional experience, he has crafted go-to-market strategies for brands like Abbott in Singapore , Genpact and CL Educate apart from the other small and medium businesses which have witnessed growth through his marketing and strategy consultation. Businesses that have business units more than a hundred can raise complexity. After plotting each product line or business unit on the nine cell matrix, strategic choices are made depending on their position in the matrix. As noted earlier, the organization lists important factors and then assigns a weighting to each.

GE

There was a time when every technology company had its own mp3 player. Drivers of the GE McKinsey Matrix Before any business can plot their products on the matrix, they must first define both competitive advantage and industry attractiveness. Strategies here are based on strong, average, and weak competitive advantage and high, medium, and low industry attractiveness. We all have seen those prices and some of us even understand why would a shop owner price something like that. What is GE nine cell planning grid? Lorem ipsum dolor sit amet, consectetur adipiscing elit.