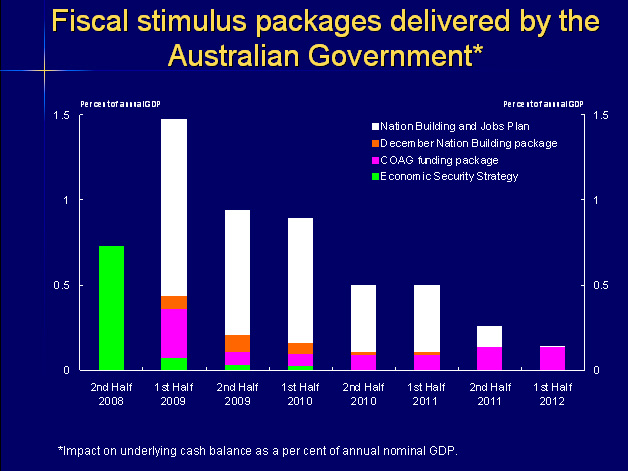

Fiscal policy refers to the government's use of its spending and taxation powers to influence the level of economic activity. This can be used to stabilize the economy during times of recession or to stimulate economic growth. In Australia, the government has a range of tools at its disposal to implement fiscal policy, including changes to government spending, tax rates, and social security payments.

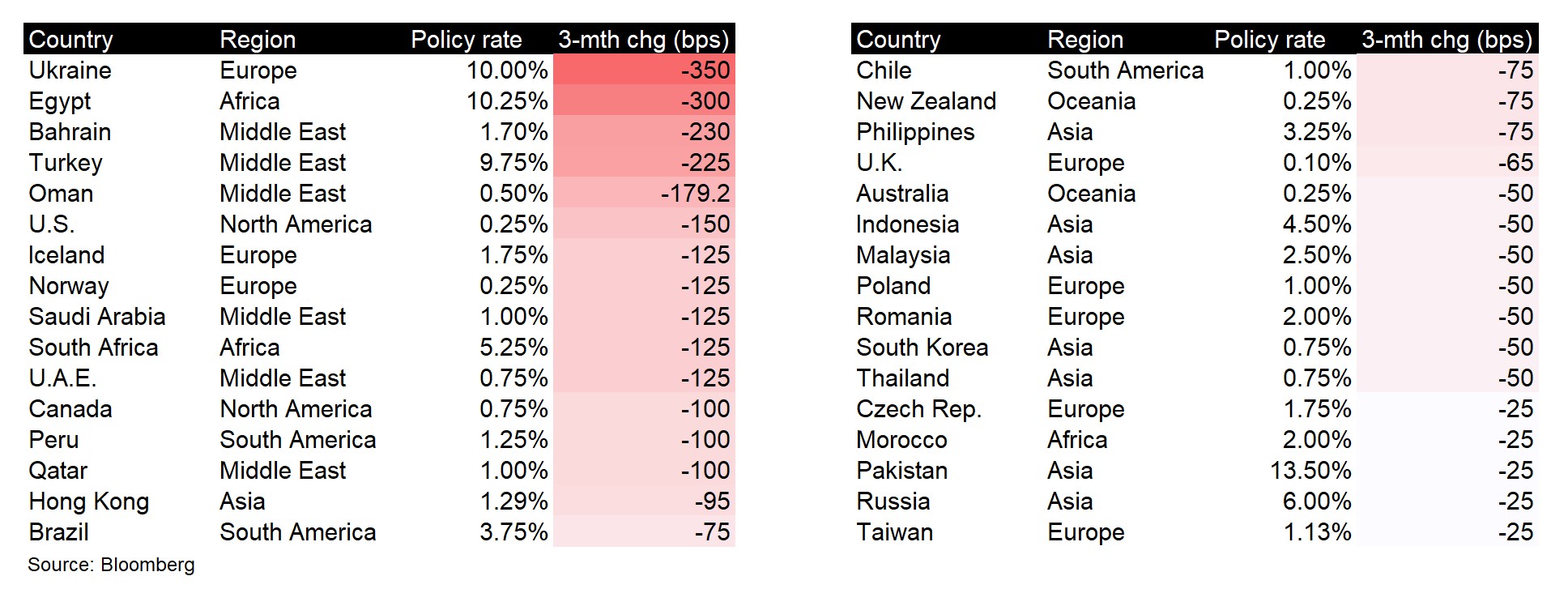

Monetary policy, on the other hand, refers to the use of interest rates and the money supply to influence economic activity. The central bank in Australia, the Reserve Bank of Australia (RBA), is responsible for implementing monetary policy. The RBA can adjust the official interest rate, which can influence the cost of borrowing for households and businesses, and thus affect spending and investment decisions. The RBA can also use other tools, such as open market operations, to influence the supply of money in the economy.

Both fiscal and monetary policy can be used to achieve various economic objectives, such as low inflation, full employment, and economic growth. However, they can also have trade-offs and unintended consequences. For example, expanding the money supply through monetary policy can stimulate economic growth, but it can also lead to higher inflation if not managed carefully. Similarly, increasing government spending through fiscal policy can stimulate economic growth, but it can also lead to higher government debt if not offset by higher tax revenues or reduced spending in other areas.

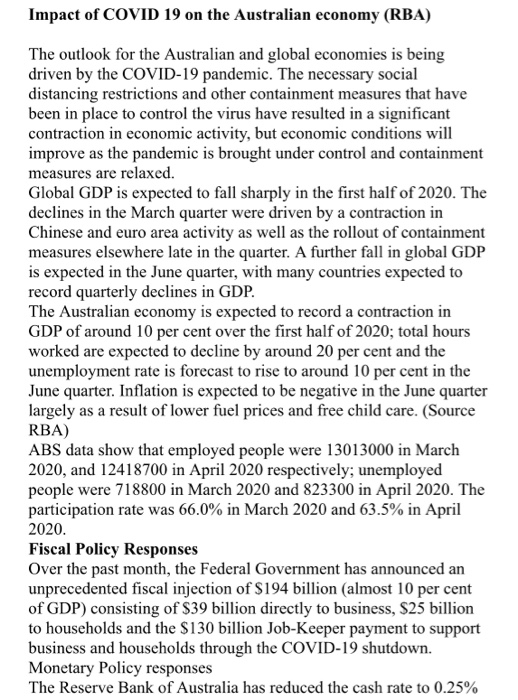

In recent years, Australia has used a combination of fiscal and monetary policy to support the economy. During the COVID-19 pandemic, for example, the government implemented a range of fiscal measures, such as increased social security payments and targeted spending on infrastructure, to support households and businesses. The RBA also lowered interest rates and engaged in quantitative easing, which involves purchasing financial assets to increase the money supply and lower borrowing costs.

Overall, fiscal and monetary policy play important roles in shaping the Australian economy and helping to achieve key economic objectives. It is important for policymakers to carefully consider the trade-offs and potential consequences of their policy decisions.