Jollibee Foods Corporation (JFC) is one of the largest and most successful fast food chains in the Philippines, with a growing international presence. The company operates a diverse portfolio of restaurant brands, including Jollibee, Chowking, Greenwich, Red Ribbon, Mang Inasal, and Burger King Philippines. In this essay, we will conduct a financial analysis of JFC to understand the company's financial health and performance.

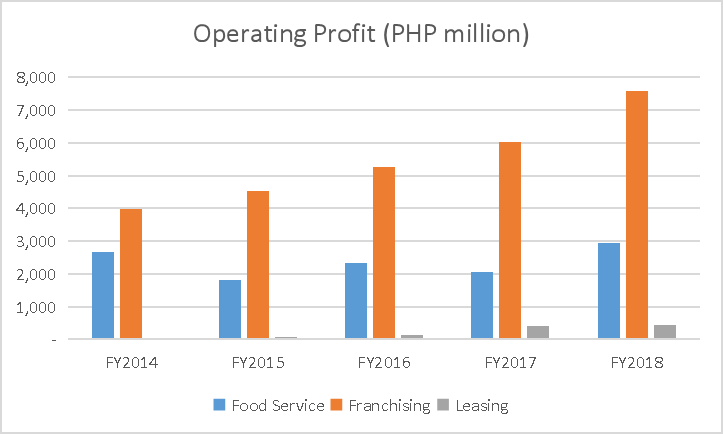

First, let's examine JFC's income statement. The company's net sales have been steadily increasing over the past few years, reaching PHP 152.2 billion (about $3.1 billion) in 2020. This growth can be attributed to the expansion of the company's restaurant network and an increase in same-store sales. However, JFC's net income has been more volatile, with significant fluctuations from year to year. In 2020, the company's net income was PHP 5.9 billion (about $119 million), a significant decline from the PHP 10.5 billion ($212 million) it reported in 2019. This decline was due to a combination of factors, including higher operating expenses, increased competition, and the impact of the COVID-19 pandemic.

Next, let's look at JFC's balance sheet. The company has a strong financial position, with total assets of PHP 100.1 billion (about $2 billion) and total liabilities of PHP 46.6 billion (about $932 million). JFC's total debt-to-equity ratio is relatively low, at 0.47, indicating that the company has a healthy balance of debt and equity financing. The company's liquidity is also strong, with a current ratio of 1.73, meaning that it has sufficient assets to cover its short-term liabilities.

Now let's turn to JFC's cash flow statement. The company's operating cash flow has been consistently positive in recent years, reaching PHP 10.8 billion (about $216 million) in 2020. This is an important indicator of the company's ability to generate cash from its day-to-day operations. JFC's investing and financing activities have also been consistent, with the company investing in capital expenditures to expand its restaurant network and financing its operations through a combination of debt and equity.

Overall, JFC is a financially strong and stable company, with consistent sales growth and a healthy balance sheet. However, the company's net income has been more volatile, and the COVID-19 pandemic has had a significant impact on its performance. Going forward, it will be important for JFC to continue to manage its expenses and adapt to the changing market environment in order to maintain its financial strength and competitiveness.