Financial analysis is the process of evaluating a company's financial performance and position using financial statements and other publicly available information. It is an important tool for investors, lenders, and management to make informed decisions about a company.

There are several key components to financial analysis. The first is the income statement, which shows a company's revenue and expenses over a given period of time. This allows analysts to see how well a company is doing at generating revenue and managing its expenses.

The second key component is the balance sheet, which shows a company's assets, liabilities, and equity at a specific point in time. This allows analysts to see the company's financial position and how well it is able to manage its debt.

The third key component is the cash flow statement, which shows the inflow and outflow of cash for a company over a given period of time. This allows analysts to see how well a company is able to generate cash and how it is using that cash.

In addition to these financial statements, analysts may also consider other factors such as a company's management, industry trends, and economic conditions.

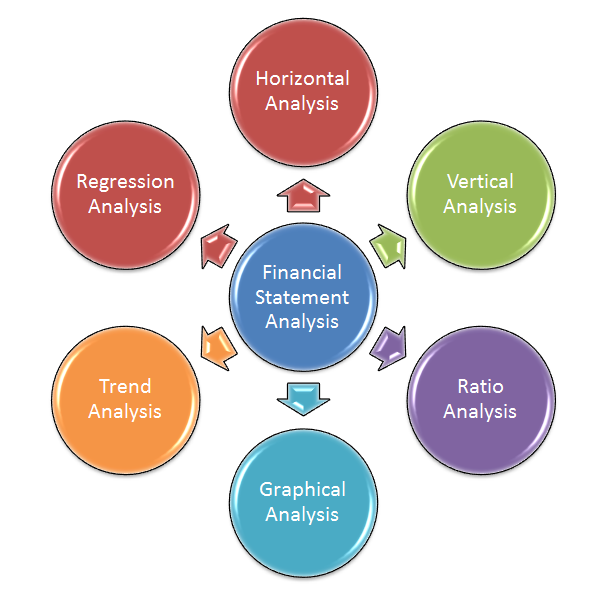

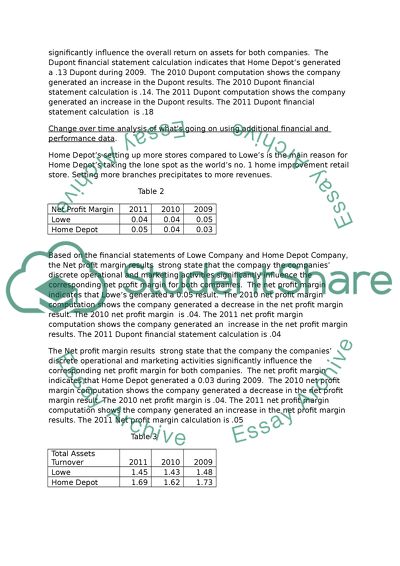

There are several methods of financial analysis, including ratio analysis, which involves calculating various financial ratios based on the information in the financial statements. These ratios can help analysts understand a company's profitability, liquidity, efficiency, and solvency.

Another method of financial analysis is trend analysis, which involves looking at a company's financial performance over time to see how it has changed and how it compares to its industry peers.

Finally, comparative analysis involves comparing a company's financial performance to that of its competitors or to industry benchmarks. This allows analysts to see how a company is performing relative to its peers and to identify any strengths or weaknesses.

Financial analysis is an important tool for investors, lenders, and management to make informed decisions about a company. It allows them to assess a company's financial performance, position, and prospects, and to identify any potential risks or opportunities. By thoroughly analyzing a company's financial information, investors and lenders can make more informed decisions about whether to invest in or lend to a company, and management can use the results of the analysis to improve the company's financial performance.