Fiat and chrysler merger analysis. Chrysler and Fiat Merger 2022-10-28

Fiat and chrysler merger analysis

Rating:

8,2/10

396

reviews

The merger between Fiat and Chrysler, which was announced in January 2014 and completed in October of that year, was a major event in the global automotive industry. The merger brought together two major players in the industry, with Fiat being a well-established European automaker and Chrysler being a major player in the North American market. This merger was seen as a way for both companies to strengthen their respective positions in the global market and to gain access to new markets and technologies.

One of the main reasons for the merger was the need for both companies to increase their scale and competitiveness. Fiat, which had been struggling in the European market, saw the merger as a way to gain access to Chrysler's strong presence in the North American market. Similarly, Chrysler saw the merger as a way to tap into Fiat's expertise in small and efficient vehicles, which were in high demand due to increasing fuel prices and stricter emissions regulations.

Another reason for the merger was the need to share resources and technology. By joining forces, both companies could pool their resources and expertise to develop new technologies and products more efficiently. This would allow them to stay ahead of the competition and meet the changing needs of the market.

There were also financial considerations behind the merger. Both companies were facing financial challenges, and the merger was seen as a way to create a more stable and financially secure entity. The merger would also create economies of scale, which would allow the combined company to lower its costs and increase its profitability.

Overall, the merger between Fiat and Chrysler was seen as a strategic move that would allow both companies to strengthen their positions in the global market and gain access to new technologies and markets. While there were some challenges and setbacks in the early stages of the merger, the combined company has since become a major player in the automotive industry and has achieved significant growth and success.

Why the Fiat

Additionally, 4 BEVs are gearing to be lined up by the China JV. The automotive industry has seen significant changes happening in recent years. We invest deep in order to bring you insightful research which can add tangible value to your business or academic goals, at such affordable pricing. Apart from being the most desired innovation, this is also an important area in terms of branding. This report is shared in order to give you an idea of what the complete Risk Analysis Report will cover after purchase. Cue self-satisfied harrumphing about overpaid workers, overhead camshafts, and creeping socialist tendencies, such as national health care. Security concerns due the advent of connected cars Legal Environmental 1.

Next

(PDF) FCA: Fiat S.p.A.

Description The proposed merger between the Fiat Chrysler Automobiles FCA and the PSA Group is one of the most significant mergers among automotive original equipment manufacturers OEMs. BYD is an electric car manufacture with advanced technological innovation. Clearly Fiat is the dominant player in the Italian market. The number of automobile manufactures is declining as massive mergers, acquisitions and consolidations occur. Changing Consumer trends:- Fast changing consumer trends are also affecting auto businesses.

Next

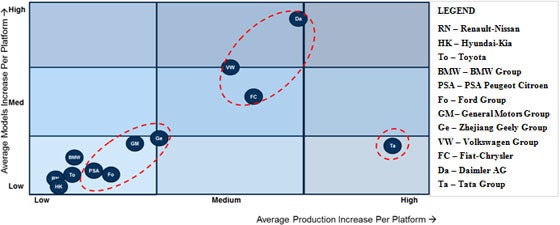

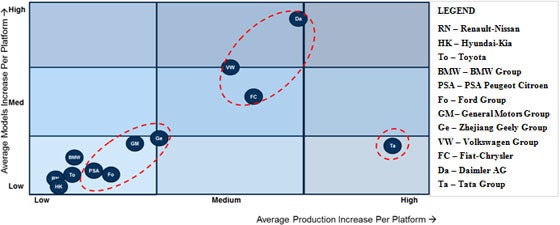

Analysis: the numbers behind the FCA and PSA merger

At 329,298 passenger car sales, Fiat has more than then next three closest competitors, Volkswagen, Ford and Renault combined at 323,202. About 86 per cent of production of the Fiat group is expected to be from their Top-5 platforms alone. Suppose a company in another field with sufficient funds enters the market, then its profitability might be hurt by many factors including lack of critical know-how and an efficient distribution network. This has pulled down gasoline prices and encouraged greater adoption of higher margin SUVs and crossover vehicles in developed markets. In 2017, FCA was trailing GM, Ford and Toyota in US in terms of market share whereas it was ahead of brands like Honda, Nissan and Hyundai. This allowed Fiat to enter the US market and boost revenue and profits. The following dimensions are as follows, power distance index, individualism versus collectivism, masculinity versus femininity, uncertainty avoidance index, and indulgence versus restraint.

Next

Strategic Analysis of the Fiat Chrysler Automobiles and PSA Group Merger

Get this report delivered straight into your email inbox for free. The SWOT analysis is therefore essential to identify the internal strengths and external opportunities that lead to the saturation of the company. The 2017 Jeep Compass has a score of 7. The Company engages in vehicle shipments along with the sale of parts, accessories and service contracts under its Mopar brand. These numbers are also on par with the top 3 automotive groups, namely VW, Toyota, and Renault-Nissan-Mitsubishi. Major recalls on automobiles have resulted ingovernment laws related to passenger safety. Environmental This section is available only in the 'Complete Report' on purchase.

Next

Chrysler and Fiat Merger

The Toyota Recall Crisis. FCA is not heavily aggressive in terms of marketing. The report provides a brief overview of each company's strengths and weaknesses in various segments, such as vehicle brands, regional stability, vehicle platforms, aftermarket business, and partnerships in developing connected and autonomous technologies. What's you view on the merger then? Ironic I know as that's why the majority of the few people who purchase them so so with their heart. An indulgence score of 68 shows that American are less likely to hold back and control their impulses but to feed the beast so to say.

Next

Analysis: For Peugeot and FCA, completing their merger is just the start

You also agree to receive email updates from us on our new reports and solutions. They couldn't pull it off, demonstrating in their failure that the first business battle between globalism and populism wasn't just lost — it was lost in a hurry. As a part of this plan, the focus as to be on differentiating and strengthening the portfolio, globalizing Jeep and Alfa Romeo, achieving cost efficiency, enhancing profit margins as well as strengthening its capital structure. We invest deep in order to bring you insightful research which can add tangible value to your business or academic goals, at such affordable pricing. Therefore, many Americans focus on self-advancement and gain.

Next

Fiat Chrysler Automobiles SWOT & PESTLE Analysis

Fiat and Chrysler merged officially in 2014 which led to the birth of FCA. Both PSA and FCA have a strong history and legacy in the automotive industry, which has unfortunately contributed to their struggling market position in the modern automotive era. In this case study, I analyze the strategies followed by Fiat S. A joint venture with Tesla could also benefit Fiat Chrysler Auto NV. The rise of the middle class is also affecting demand patterns and how brands have marketed their products.

Next

Strategic Analysis of the Fiat Chrysler Automobiles and PSA Group Merger

Appendix "Strategic Analysis and Proposal: Fiat Chrysler Automobiles 2016. This merger highlights the extent of fundamental change sweeping the industry, calling for OEMs to come together and stand firm against the disruption wave. This report is shared in order to give you an idea of what the complete Technology Landscape and Outlook Report will cover after purchase. How to Reference This Page? Market share of FCA climbed in Argentina last year but has kept falling in Brazil for the previous three years having come down from 19. Unlike other global auto companies, PSA and FCA did not act quickly in entering the Chinese market and failed to respond to the massive auto demand from this country. New York: Value Line Publishing LLC, 2015.

Next

ANALYSIS: Fiat

This recall made national headlines as a family of four died because of the faulty gas pedal design. From affordable to luxury, FCA sells a wide range of vehicles offering its customers a large range of vehicles to choose from. Social This section is available only in the 'Complete Report' on purchase. Vehicle Recalls:- FCA has been forced t make several recalls in the recent period. . Get this report delivered straight into your email inbox for free. Broad differentiation seems to be their current strategy.

Next

Fiat 500 USA: Fiat Night Before Christmas 2022

Most of that capacity is in China, a market of 21 million cars a year, and analysts said the merger is the best chance for a turnaround. Laws related to environment friendliness and carbon emissions are tightening globally. It has come a long way since then with the industrial revolution and the great technological advancement of the 21 st century. Americans like to enjoy life and have fun as way to relieve any stress and tensions from working all day and or week. From 2011 to 2015, 5-year average growth rate for revenue amounted to 4. EMEA includes Europe, Middle East and Africa.

Next