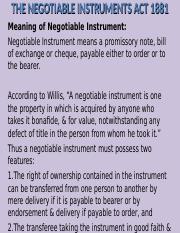

Negotiable instruments are financial instruments that can be transferred from one party to another through negotiation. They are commonly used in commercial transactions and are an important part of the financial system. There are several features that define negotiable instruments and make them unique.

One of the most important features of negotiable instruments is their negotiability. This means that they can be transferred from one party to another by simply transferring possession of the instrument. The transfer does not require any formal documentation or the consent of the issuer, as long as the instrument is properly endorsed. This makes negotiable instruments highly liquid and allows them to be easily traded.

Another feature of negotiable instruments is their transferability. This means that the instrument can be transferred by endorsement and delivery, which involves the transferor signing the back of the instrument and delivering it to the transferee. The transferee becomes the holder of the instrument and has the right to enforce the instrument against the issuer.

Negotiable instruments also have the feature of enforceability, which means that they can be enforced in a court of law. The holder of the instrument has the right to sue the issuer for payment if the issuer fails to fulfill their obligation under the instrument. This feature provides protection for the holder and helps to ensure the integrity of the financial system.

There are several types of negotiable instruments, including promissory notes, checks, and drafts. Promissory notes are written promises to pay a certain amount of money at a future date. Checks are orders to a financial institution to pay a certain amount of money to a designated party. Drafts are orders to pay a certain amount of money at a future date or on demand.

In conclusion, negotiable instruments are financial instruments that can be transferred through negotiation and have the features of negotiability, transferability, and enforceability. They are an important part of the financial system and are commonly used in commercial transactions.

Introduction to Negotiable Instruments

Bill of Exchange A Illustration: A, an exporter, exports items worth Rs. Typically employed as a short-term trade credit, the manufacturer settles the outstanding balance on or before the note's expiration date. For example, If the time of payment depends on the death of a specific individual, it is considered as a negotiable instrument, as death is a specific event. If the payee is not mentioned in the instrument then the transfer can be made by mere delivery. The payment function allows the use of negotiable instruments instead of cash payment which may be risky to transfer directly. The Reserve Bank of India Act, 1934, makes it a criminal offence to issue such bills or notes, and renders them unlawful and unenforceable in court. However, the title will be good only if the receiver has the instrument in good faith and for consideration.

Negotiable Instruments

They serve as a guarantee that the person making and signing such a document as the payee shall be under an obligation to pay the specified amount of money to the mentioned person or the assignees, or the holder of the instrument at a certain future date or at demand. Furthermore, the bearer cannot be given any further instructions or requirements for them to obtain the money specified on the instrument. Payable by money: Negotiable Instruments are payable by the legal tender money of India. Promissory Notes Promissory notes are a signed document of a written promise to pay a specified amount to a specific person at a given date. Further, they are freely transferable and can be forwarded to the parties, which then become the owner of the property within the instrument. The drawer the creditor prepares the bill.

FEATURES OF NEGOTIABLE webapi.bu.edu

In the case of bearer instruments, delivery to the transferee is sufficient. The promissory note gives the bank the authority to pursue legal action against the borrower to resolve any outstanding issues in the case of default despite all verifications. If the payee is mentioned, then the transfer has to be made by endorsement in the name of another person or assignee or bearer. In the case of bearer instruments, delivery to the transferee is sufficient. Unless the drawer moves the bill of exchange to a different payee, the drawer and the payees are the same. Popularity: Because of their ease negotiability and speedy cures, negotiating tools are useful in business negotiations.