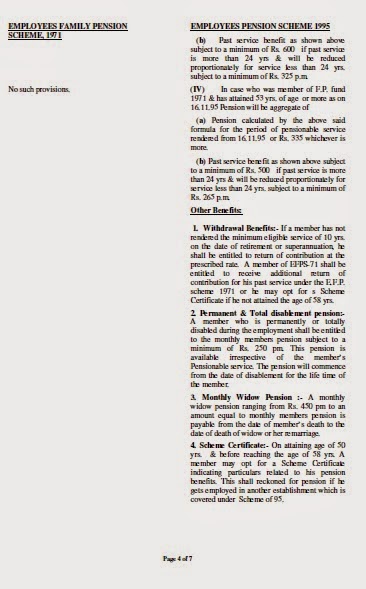

The Family Pension Scheme 1971 was a social security measure implemented by the Government of India to provide financial support to the families of government employees in the event of their death or disability. This scheme was introduced as a replacement for the existing Death-cum-Retirement Gratuity Scheme, which had been in place since 1952.

Under the Family Pension Scheme 1971, the eligible family members of a government employee who dies while in service or becomes permanently disabled are entitled to receive a monthly pension. The amount of the pension is calculated as a percentage of the employee's last pay drawn, and is paid to the family until the death of the pensioner.

The family pension scheme covers all regular employees of the central and state governments, as well as employees of public sector undertakings, autonomous bodies, and local bodies. It is also applicable to employees of universities and other educational institutions, as well as judges of the Supreme Court and High Courts.

The eligibility for the family pension scheme is determined by the nature of the employee's death or disability. If the employee dies while in service, the family pension is payable to the spouse, children, and dependent parents of the employee. If the employee becomes permanently disabled, the family pension is payable to the spouse and children of the employee. In the event that the employee has no spouse or children, the pension is payable to the dependent parents of the employee.

The family pension scheme has played a crucial role in providing financial security to the families of government employees in India. It has helped to alleviate the burden of financial stress in times of crisis and has enabled families to maintain a decent standard of living even in the absence of their breadwinner.

In conclusion, the Family Pension Scheme 1971 is a valuable social security measure that has provided much-needed financial support to the families of government employees in India. It has played a significant role in ensuring that families are not left in financial hardship in the event of the death or disability of their breadwinner.