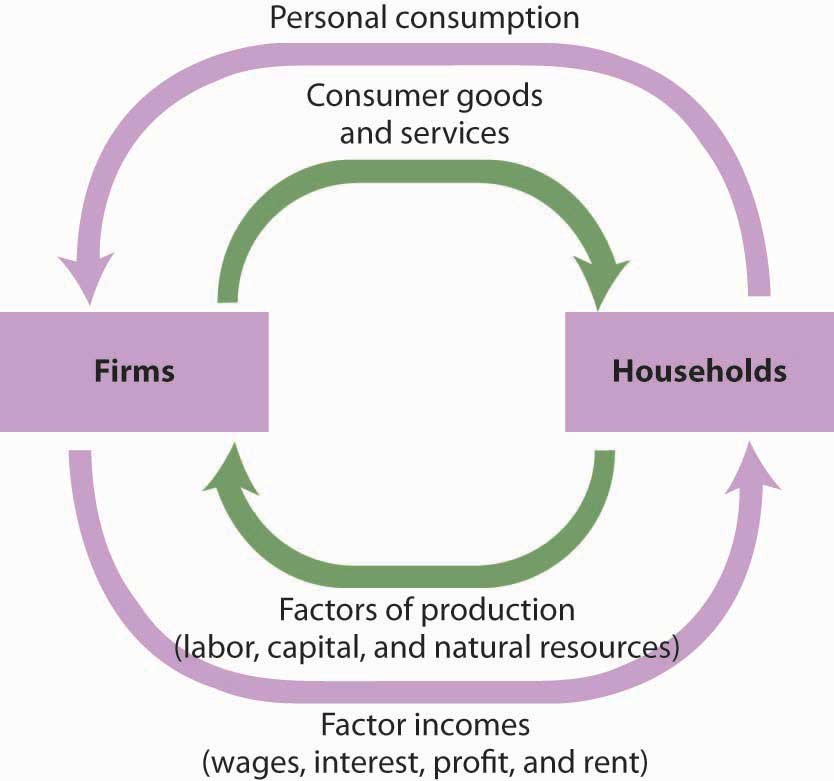

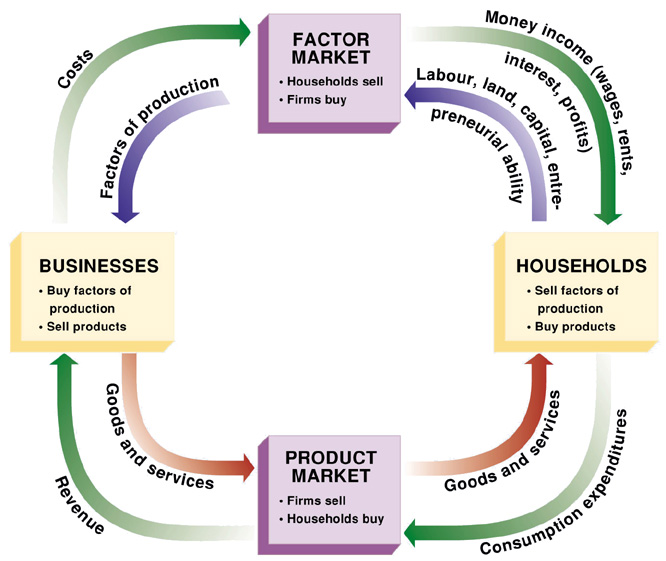

In macroeconomics, consumption refers to the use of goods and services by households. It is a key component of aggregate demand and plays a central role in determining the overall level of economic activity. There are several factors that can influence consumption in an economy.

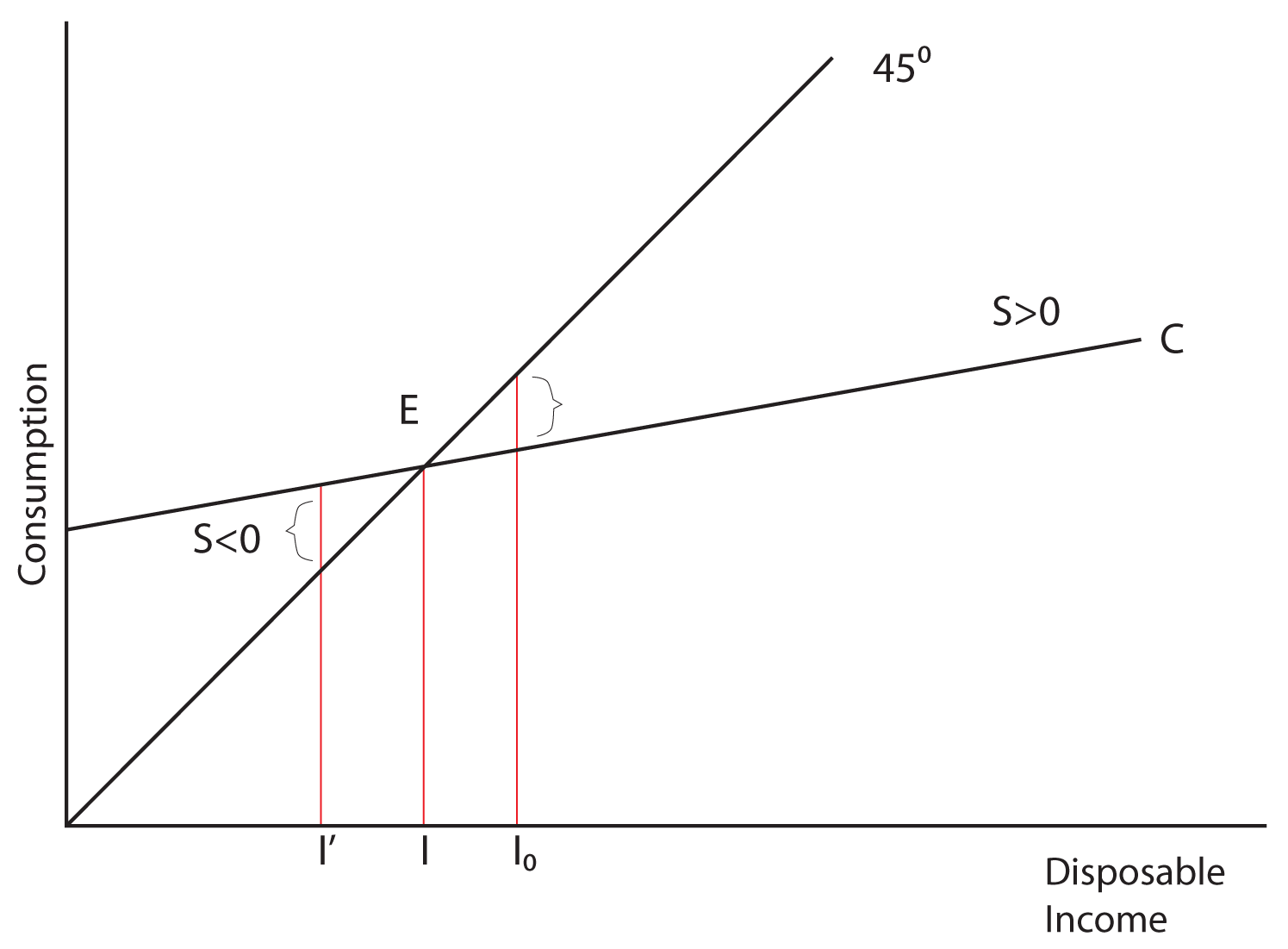

One key factor is income. As households’ incomes rise, they tend to increase their consumption of goods and services. This is known as the income effect, which states that an increase in income leads to an increase in consumption. Conversely, a decrease in income will typically lead to a decrease in consumption. This relationship is known as the consumption function.

Another factor that can influence consumption is the level of wealth in an economy. If households feel that they have a sufficient level of wealth, they may be more likely to consume goods and services. On the other hand, if they feel that their wealth is insufficient or uncertain, they may be more likely to save rather than consume.

Interest rates can also affect consumption. If interest rates are high, it may be more expensive for households to borrow money, which can reduce their ability to consume. Conversely, if interest rates are low, it may be easier and cheaper for households to borrow money, which can increase their ability to consume.

Consumer confidence is another factor that can impact consumption. If households are confident in the economy and their personal financial situation, they may be more likely to consume goods and services. On the other hand, if they lack confidence in the economy or their own financial situation, they may be more likely to save rather than consume.

Finally, the availability of credit can also affect consumption. If credit is readily available, households may be more likely to use it to finance their consumption of goods and services. On the other hand, if credit is scarce or expensive, households may be more likely to save rather than borrow in order to consume.

In conclusion, there are several factors that can influence consumption in an economy. These include income, wealth, interest rates, consumer confidence, and the availability of credit. Understanding these factors can help policymakers and businesses better predict and influence consumption patterns in the economy.