ExxonMobil is one of the world's largest publicly traded international oil and gas companies, with operations in over 50 countries and a strong presence in both the upstream and downstream sectors of the industry. The company has a long history dating back to the late 19th century and has consistently ranked among the top global energy firms in terms of revenue and market capitalization.

ExxonMobil's business strategy has evolved over the years, but one constant has been its focus on maximizing shareholder value through a combination of operational excellence, technological innovation, and financial discipline. The company has a reputation for being a leader in exploration and production, with a strong portfolio of assets and a proven track record of discovering and developing new oil and gas reserves.

In recent years, ExxonMobil has faced a number of challenges, including declining oil prices, increased competition, and increased scrutiny from regulators and investors over its environmental and climate-related risks. In response to these challenges, the company has implemented a number of strategic initiatives designed to improve its financial performance and address these risks.

One key element of ExxonMobil's strategy has been its emphasis on technology and innovation. The company has a long history of investing in research and development, and it has made significant investments in advanced technologies such as advanced drilling and production techniques, enhanced oil recovery methods, and low-emission energy technologies. These investments have helped the company to maintain its position as a leader in the industry, while also positioning it to benefit from the growing demand for cleaner energy sources.

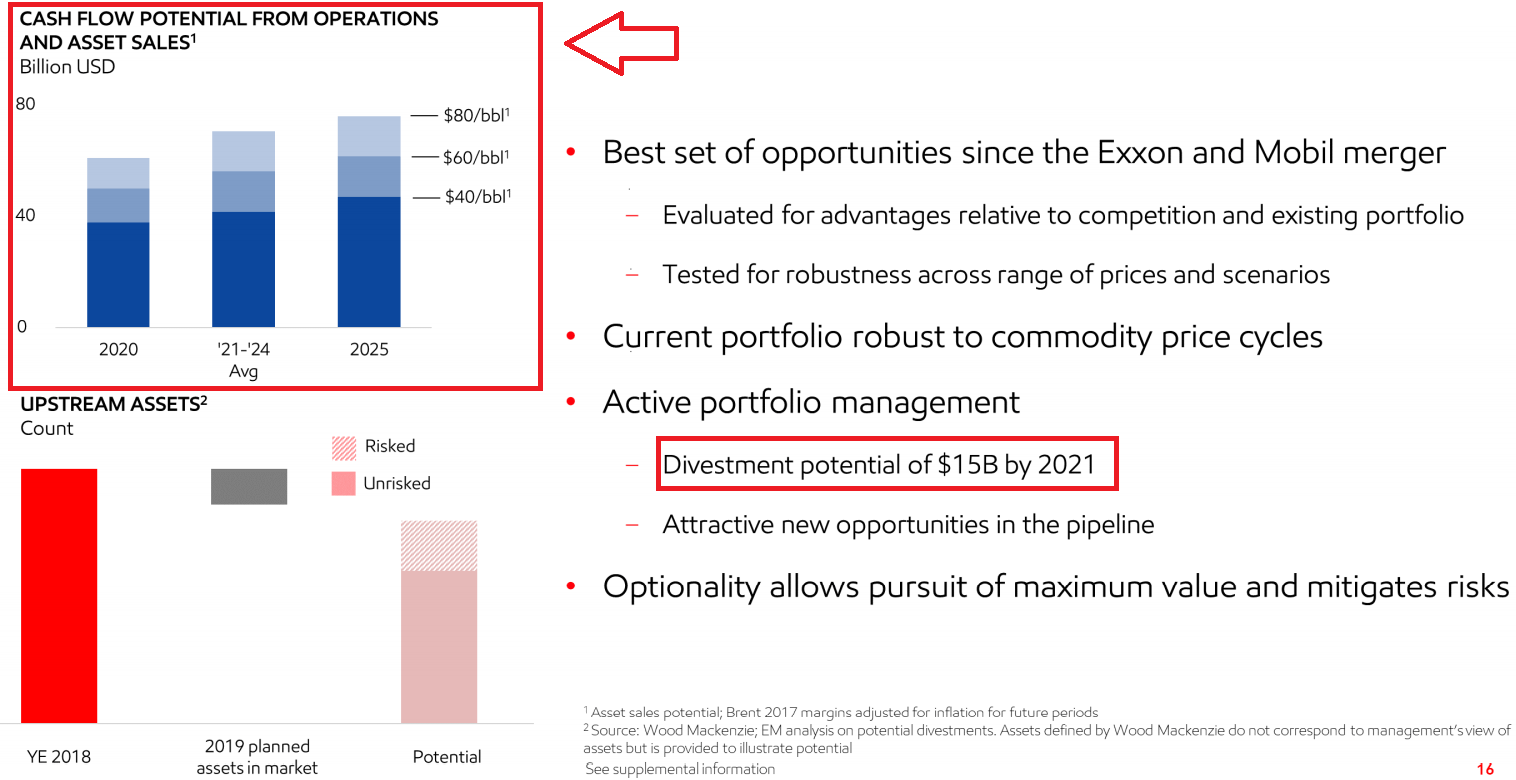

In addition to its focus on technology and innovation, ExxonMobil has also emphasized financial discipline in its business strategy. The company has implemented a number of cost-cutting measures and has sought to optimize its capital expenditure program in order to maximize shareholder value. This focus on financial discipline has helped the company to maintain a strong financial position even in times of market volatility and economic uncertainty.

Another key element of ExxonMobil's strategy has been its commitment to operational excellence. The company has a strong track record of efficiently and effectively managing its operations, and it has implemented a number of initiatives designed to improve efficiency and reduce costs. This focus on operational excellence has helped the company to maintain its competitive advantage and to deliver strong financial performance over the long term.

Overall, ExxonMobil's business strategy has been focused on maximizing shareholder value through a combination of operational excellence, technological innovation, and financial discipline. While the company has faced a number of challenges in recent years, it has remained a leader in the energy industry and has consistently delivered strong financial performance.