Extended trial balance definition. Trial balance worksheet definition — AccountingTools 2022-10-17

Extended trial balance definition

Rating:

8,7/10

491

reviews

An extended trial balance is a financial statement that lists all of the accounts in a company's chart of accounts and their balances at a specific point in time. It is an extended version of the trial balance, which is a preliminary step in the process of preparing financial statements.

The purpose of the extended trial balance is to ensure that the balances in the chart of accounts are accurate and complete. It is a way to verify that all transactions have been recorded correctly and that the debits and credits are in balance. The extended trial balance also helps to identify any errors or discrepancies in the financial records.

The extended trial balance includes all of the accounts in the chart of accounts, including those that are not included in the trial balance. This includes the income statement accounts, such as revenues and expenses, as well as the balance sheet accounts, such as assets, liabilities, and equity. The extended trial balance also includes any adjusting entries that are necessary to accurately reflect the financial position of the company.

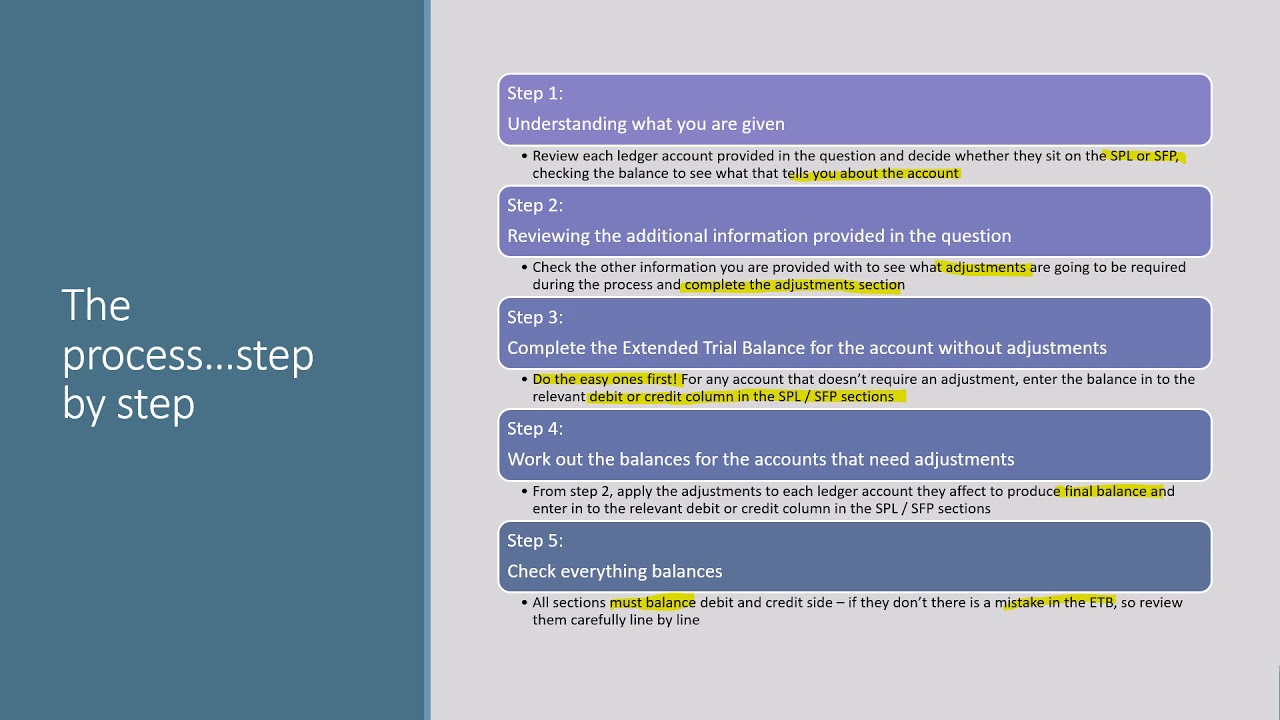

To prepare an extended trial balance, the accountant begins by preparing a list of all of the accounts in the chart of accounts and their balances as of the date of the extended trial balance. The accountant then reviews the accounts and balances to ensure that they are accurate and complete. Any errors or discrepancies are corrected before the extended trial balance is finalized.

The extended trial balance is a useful tool for companies of all sizes, as it helps to ensure the accuracy and completeness of their financial records. It is an important step in the process of preparing financial statements and is essential for making informed business decisions.

What goes where on an extended trial balance?

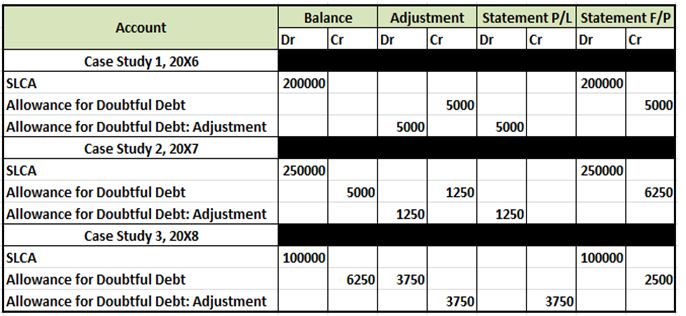

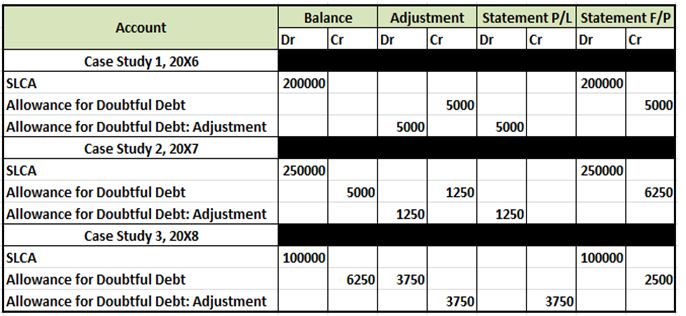

Thus, it provides mathematical accuracy. This method is more appropriate in assessing the health of the organisation in financial terms. Q1 WHY opening inventory is a debit balance and why its just recorded on the debit side of profit or loss PL When we record this entry in previous year closing we would record that DRSOFP CRPL then how when we brought forward this we record just on the debit side of PL in the extended trial balance. This trial balance has the final balances in all the accounts, and it is used to prepare the financial statements. The adjustment columns on an extended trial balance are for entering journals that have been completed after the year end balancing has taken place. Such error is the error of reversal.

Next

Trial Balance: Definition, How It Works, Purpose, and Requirements

The adjusted trial balance is typically printed and stored in the year-end book, which is then archived. The trial balance template is an organized template in Excel Google Sheets and Open Office Calc that makes you able to build statements of all ending balances of ledger accounts on a specific date. Fill in the blank fields to create the perfect report. These are the account totals as of the end of the accounting period, as compiled from the general ledger. Identify whether they relate to the statement of profit or loss or statement of financial position and insert the ledger account balances in the appropriate boxes 3 Include the adjustments where relavant. Purpose of extended trial balance An extended trial balance is used to adjust trial balance figures for: - Errors - Accruals and prepayments.

Next

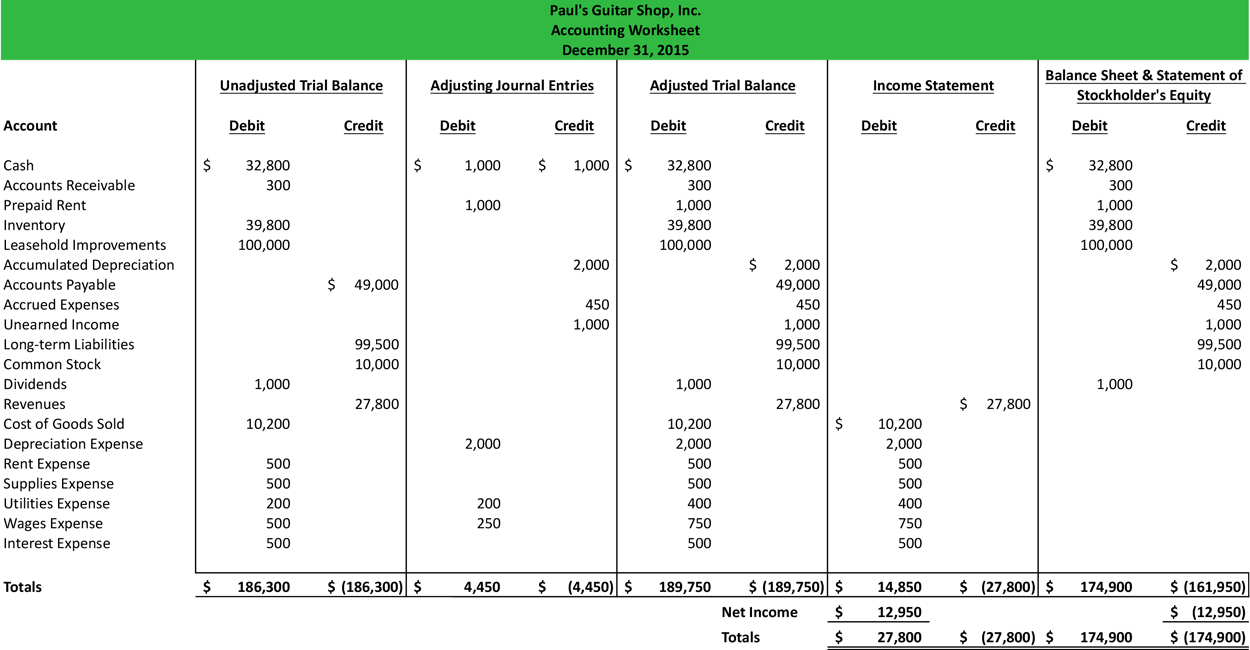

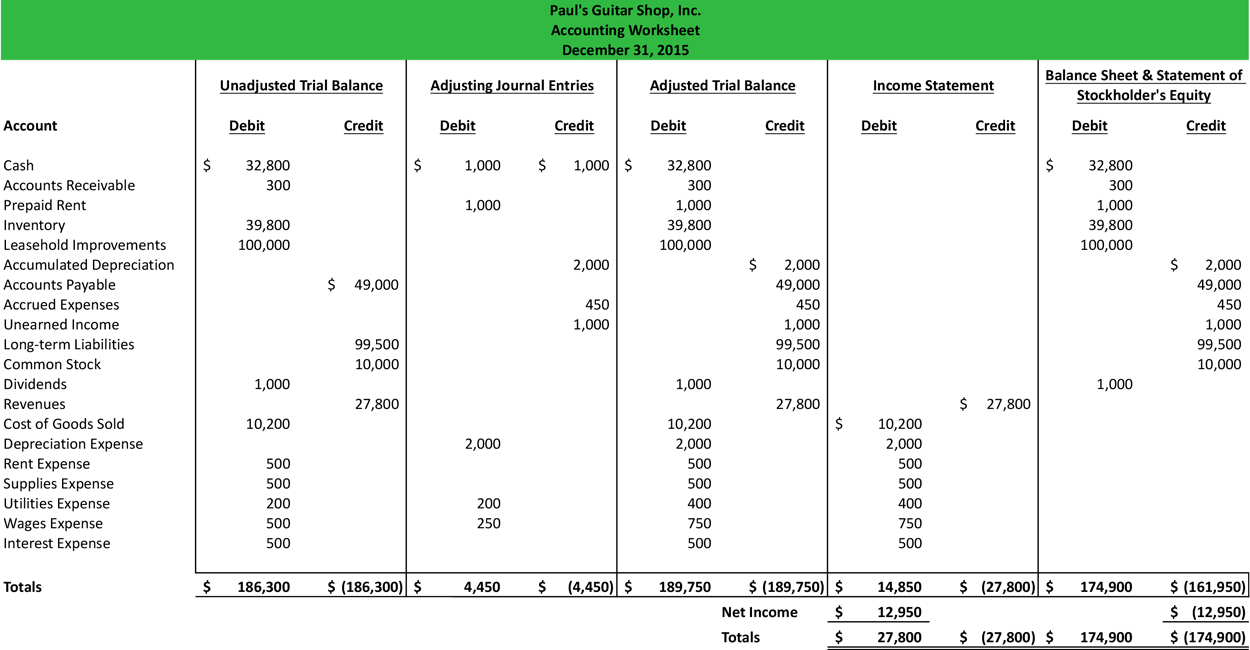

lecture 7

A variation on the format of the extended trial balance is to begin with initial balances, add or subtract adjusting journal entries, and finish with ending balances. Thus, there are eight columns in total, with two columns assigned to each of the preceding categories. Then the first ATM was set up in 1967 by Barclays Bank in Enfield. Who Uses the Trial Balance? I can give a more detailed answer if you want to ask a more specific question. Then, when the accounting team corrects any errors found and makes adjustments to bring the financial statements into compliance with an accounting framework such as GAAP or IFRS , the report is called the adjusted trial balance. Moreover, it also identifies the accurate balance of both debit and credit entries based on the general ledger transactions.

Next

Adjusted trial balance example and explanation — AccountingTools

Once a book is balanced, an adjusted trial balance can be completed. The main aim of creating a trial balance is to attain a mathematical accuracy for any organisation's transactions. The significant difference is that the commission error occurs due to an unintentional oversight. Pawar Sujay Sujay is CEO and Co-Founder of Closeencountersinwar, the company behind Astrof. Balance sheet section Which account would appear in the debit column of the trial balance? A balance sheet records not only the closing balances of accounts within a company but also the assets, liabilities, and equity of the company.

Next

What is Extended Trial Balance

A variation on the format of the extended trial balance is to begin with initial balances, add or subtract adjusting journal entries, and finish with ending balances. Transferring information from T-accounts to the trial balance requires consideration of the final balance in each account. Example of an Adjusted Trial Balance The following report shows an adjusted trial balance, where the initial, unadjusted balance for all accounts is located in the second column from the left, various adjusting entries are noted in the third column from the left, and the combined, net balance in each account is stated in the far right column. The debit should have been to the utilities expense account, but the trial balance will still show that the total amount of debits equals the total number of credits. This view helps you see what adjustments have been made and how they have affected the profit.

Next

What is Trial Balance? Definition of Trial Balance, Trial Balance Meaning

. Use the extended trial balance to see the sum of the movements adjustments made to each nominal account in the current set of accounts. The trial balance template is an organized template in Excel Google Sheets and Open Office Calc that makes you able to build statements of all ending balances of ledger accounts on a specific date. To do this simply click the relevant row. Trial balance plays a key role in the companys financial department it reports on ending debit credit balances in every account.

Next

Extended Trial Balance, Sample of Essays

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

However, it is a useful extension of the knowledge you acquired on the preparation of a trial balance in the Level 2 accounting units and provides a strong foundation for the Level 3 unit, Final Accounts Preparation. The trial balance template is an organized template in Excel, Google Sheets, and Open Office Calc that makes you able to build statements of all ending balances of ledger accounts on a specific date. Arrears is a commercial term meaning a payment that is past its due date. Balance Sheet The key difference between a trial balance and a balance sheet is one of scope. Entry in Wrong Amount An entry could have been made in the wrong amount. ABC International Trial Balance July 31, 20XX.

Next

Extended Trial Balance Financial Statement

Such error is an error or omission. The extended trial balance is often referred to as a worksheet which provides a useful aid where a large number of adjustments are needed prior to the preparation of the financial statements the extended trial balance is drawn up on specifically pre-printed stationery on which suitable columns are printed at the end is an example of an extended trial balance. The adjustment columns on an extended trial balance are for entering journals that have been completed after the year end balancing has taken place. It brings all the balances of different ledger accounts into one document. It is important to note that the computer still uses the same techniques, although it may be that the only output reviewed by the owners is the final statement of profit or loss and statement of financial position. However, it is the source document if you are manually compiling financial statements. In addition, it should state the final date of the Finally, if some adjusting entries were entered, it must be reflected on a trial balance.

Next

Trial balance worksheet definition — AccountingTools

However, a trial balance cannot detect It depends. It is not an official What Does a Trial Balance Include? The Trial Balance Trial Balance Trial Balance is the report of accounting in which ending balances of a different general ledger are presented into the debitcredit column as per their balances where debit amounts are listed on the debit column and credit amounts are listed on the credit column. This generally involves the matching of revenues to expenses under the matching principle, and so impacts reported revenue and expense levels. This additional level of detail reveals the activity in an account during an accounting period, which makes it easier to conduct research and spot possible errors. The trial sheet ensures that the entries of any given company are mathematically correct. It is not distributed elsewhere within an organization, and it is not read by outside parties, other than the auditors.

Next

Trial Balance

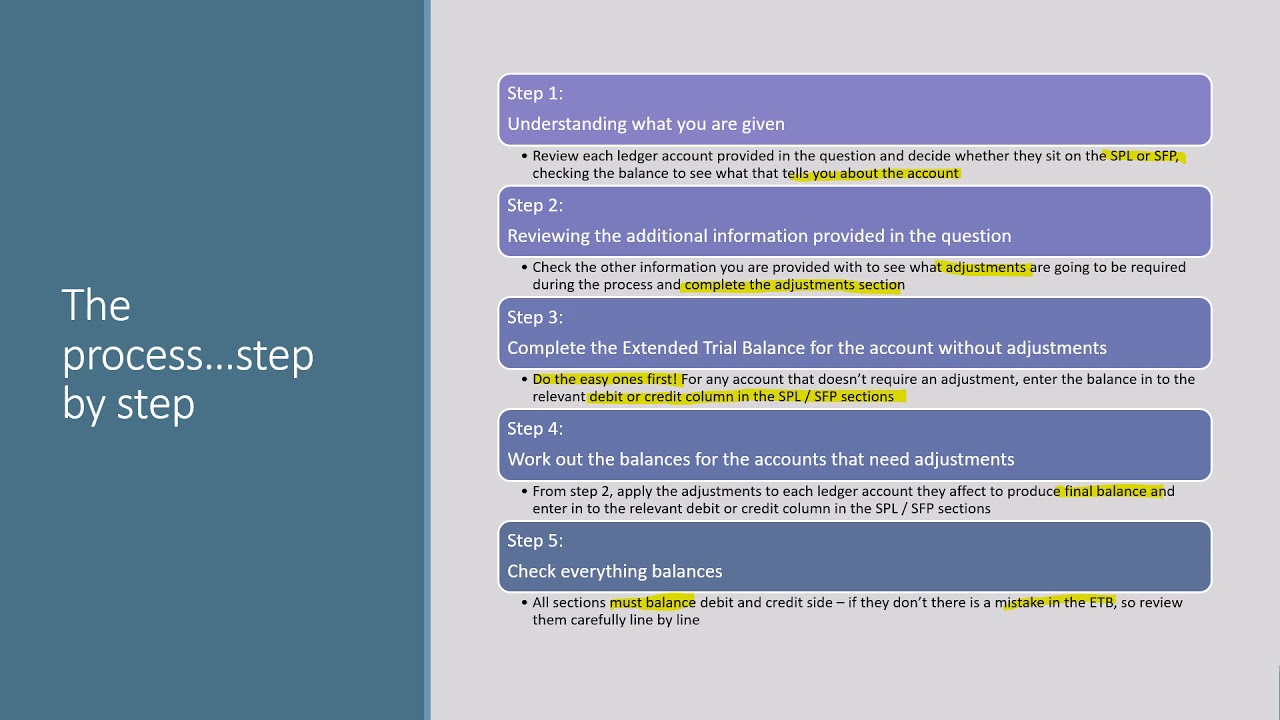

A trial balance that gives a vertical listing of all the ledger account balances with three additional columns for adjustments, accruals, and prepayments, and a final two columns each containing a debit and a credit side that show the entries in the profit and loss account and the balance sheet. The trial balance is strictly for use within the accounting department. The main difference from the general ledger is that the general ledger shows all of the transactions by account, whereas the trial balance only shows the account totals, not each separate transaction. Any computerized accounting system automatically generates financial statements from the trial balance, so the extended trial balance is not a commonly generated report in computerized systems. The trial balance is strictly a report that is compiled from the accounting records. Extended trial balance preparation 10 steps to complete an extended trial balance Step 1: Draw up the trial balance, enter it on the ETB and add it up. Nowadays, however, most businesses keep their accounting records on a computerised system.

Next

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)