Profit maximization is the goal of any business, and it refers to the process of maximizing the amount of profit a company generates through its operations. Profit is the difference between a company's total revenues and its total costs, and it represents the value that a company is able to create for its shareholders. There are a number of different ways that a company can go about maximizing its profits, including increasing revenues, decreasing costs, and finding ways to optimize the balance between the two.

One way that a company can maximize its profits is by increasing its revenues. This can be done through a variety of means, such as expanding the market for the company's products or services, increasing the price of its products or services, or increasing the volume of its sales. For example, a company might decide to enter new markets or target new customer segments in order to increase its revenues. Alternatively, it might decide to invest in research and development in order to create new products or improve existing ones, which can also lead to increased sales and higher revenues.

Another way that a company can maximize its profits is by decreasing its costs. This can be done through a variety of means, such as reducing the cost of raw materials, streamlining production processes, or negotiating better terms with suppliers. For example, a company might decide to switch to a cheaper supplier for a key raw material in order to reduce its costs. Alternatively, it might invest in new technology or equipment that allows it to produce its products more efficiently, thereby reducing its overall costs.

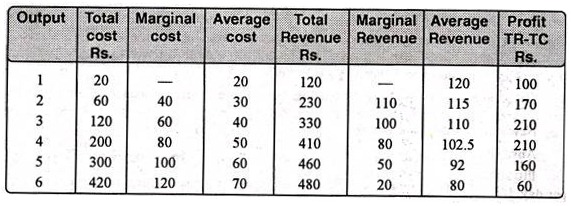

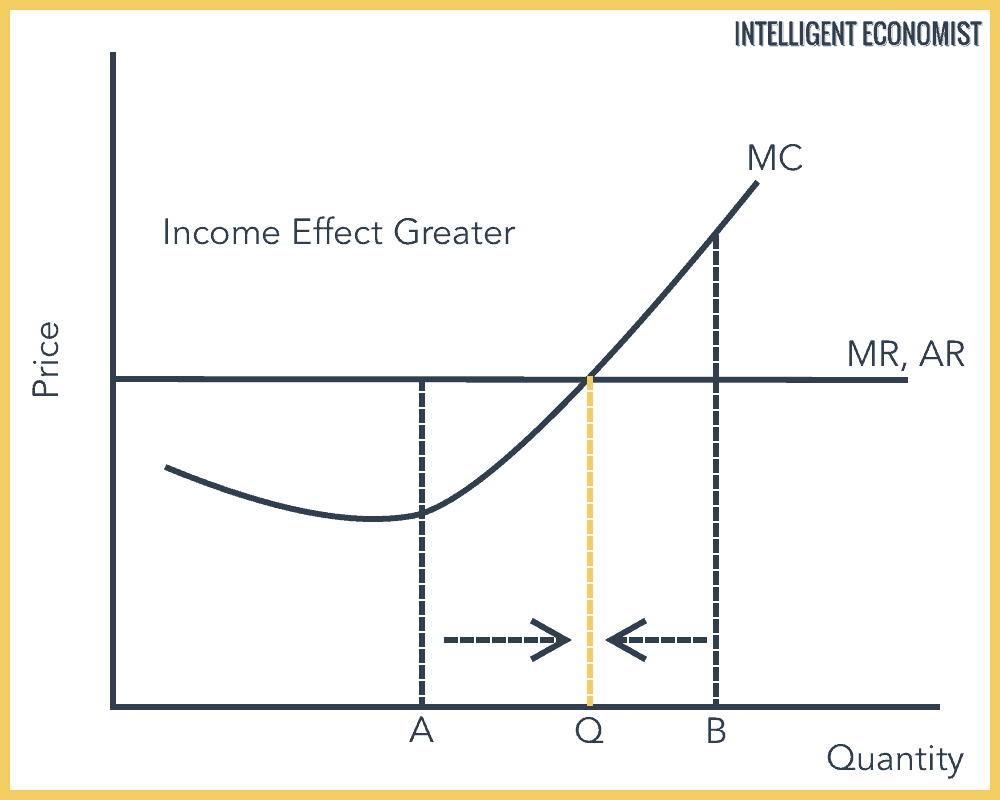

Finally, a company can also maximize its profits by finding the optimal balance between its revenues and its costs. This involves carefully analyzing the relationship between the two and finding the point at which the company is able to generate the most profit. For example, a company might decide to increase the price of its products in order to generate more revenue, but if the price increase is too large, it could also lead to a decrease in demand and ultimately lower profits. On the other hand, if the company is able to reduce its costs significantly, it might be able to maintain the same level of profits even if it reduces its prices.

In summary, profit maximization is the process of maximizing the amount of profit a company generates through its operations. This can be achieved through a variety of means, including increasing revenues, decreasing costs, and finding the optimal balance between the two. By carefully analyzing its business operations and making strategic decisions, a company can maximize its profits and create value for its shareholders.