Financial intermediaries play a crucial role in the economy by facilitating the flow of funds between borrowers and lenders. They provide a range of services that help to match savers with borrowers, reducing the cost and risk of borrowing and lending.

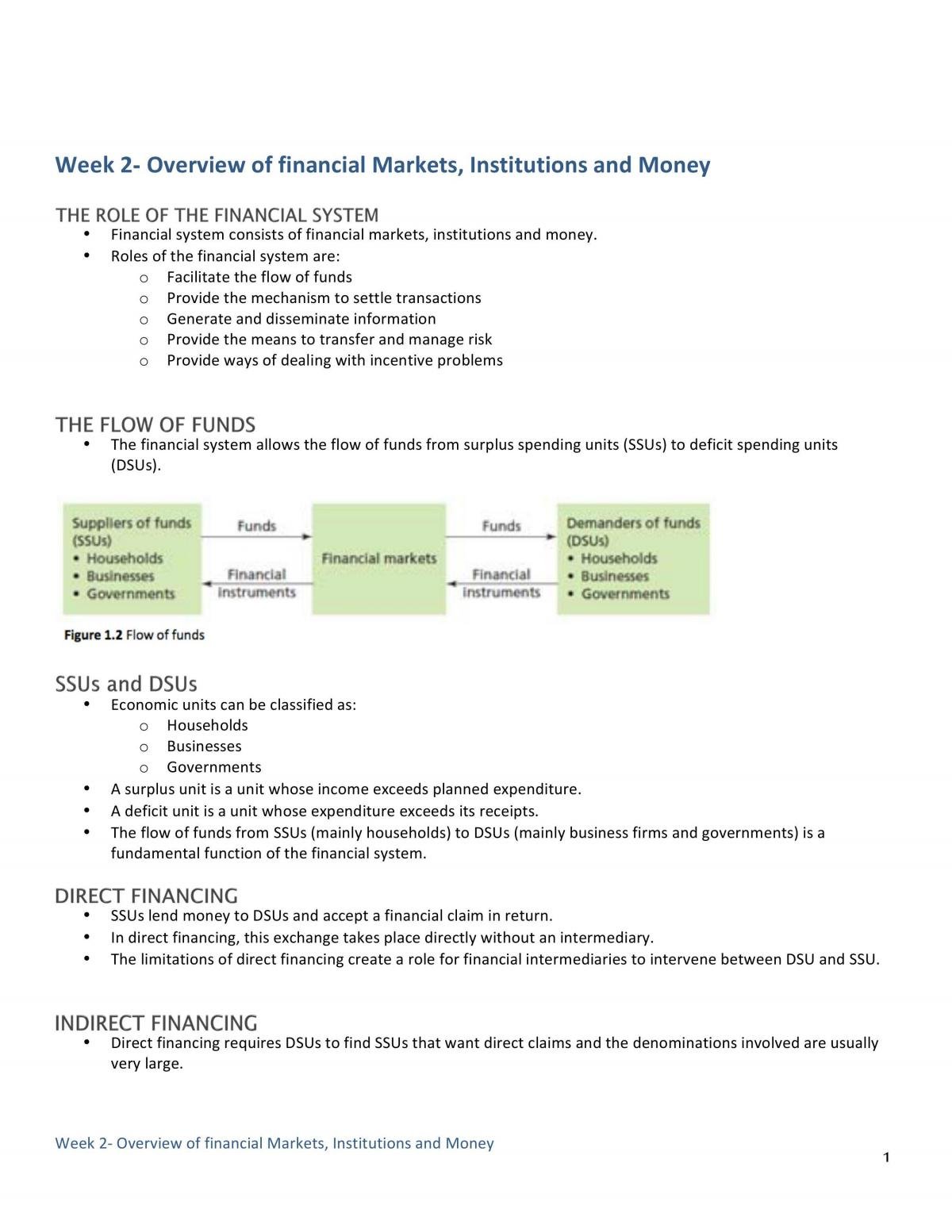

One of the primary functions of financial intermediaries is to channel savings from households and firms into investments that can be used to finance productive economic activities. This process is known as financial intermediation. By acting as intermediaries, financial institutions are able to diversify the risk of lending, which makes it easier for borrowers to access credit. For example, a bank may pool together deposits from many individual savers and use those funds to lend to a variety of borrowers, such as businesses or individuals. This diversification helps to reduce the risk of default, which makes borrowing less risky for both the borrower and the lender.

In addition to channeling savings into investments, financial intermediaries also play a crucial role in the payment system. They facilitate the transfer of funds between different parties, allowing individuals and businesses to make and receive payments for goods and services. For example, when an individual uses a debit or credit card to make a purchase, the financial intermediary processes the transaction and transfers the funds from the individual's account to the merchant's account. This process helps to reduce the risk of fraud and makes it easier for individuals and businesses to conduct transactions.

Financial intermediaries also play a key role in the creation and allocation of financial assets, such as stocks and bonds. By issuing financial assets, firms and governments are able to raise capital that can be used to fund investments and other productive activities. Financial intermediaries, such as investment banks, help to create and distribute these financial assets, making it easier for investors to diversify their portfolios and manage risk.

In summary, financial intermediaries play a vital role in the economy by facilitating the flow of funds between borrowers and lenders, facilitating payments, and creating and allocating financial assets. Their services help to reduce the cost and risk of borrowing and lending, making it easier for individuals and businesses to access credit and finance productive economic activities.

:max_bytes(150000):strip_icc()/financial-market-Final-c0c74b4f21cd400d9c70ef9790a5ddb9.png)