Ecommerce online payment systems have revolutionized the way we shop and pay for goods and services. These systems allow consumers to make purchases from the comfort of their own homes or offices, using their computers or mobile devices. This convenience has led to a significant increase in ecommerce sales, as more and more consumers turn to online shopping.

One of the key components of an ecommerce online payment system is the payment gateway. This is the software that processes the payment transaction and ensures that the payment is secure. Payment gateways use a variety of methods to secure transactions, including encryption, tokenization, and fraud prevention algorithms.

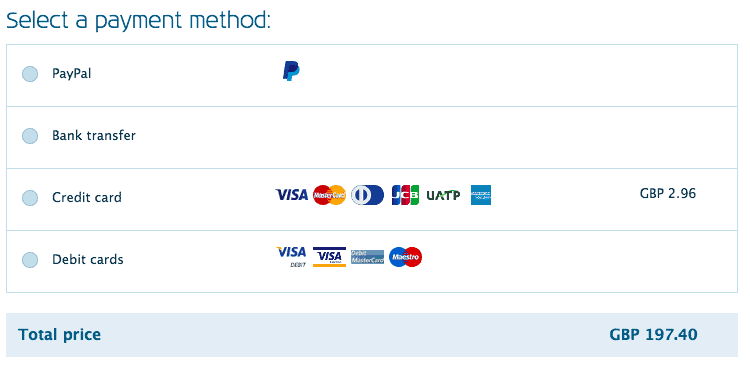

There are many different payment gateways available, each with its own unique features and benefits. Some popular payment gateways include PayPal, Stripe, and Square. These companies offer a range of payment options, including credit and debit cards, e-checks, and mobile payments.

Another important aspect of ecommerce online payment systems is the ability to accept different types of payments. Many consumers prefer to use their credit or debit cards to make online purchases, but there are also other options available. Some ecommerce sites accept e-checks, which are electronic versions of traditional checks that can be processed and cleared through the bank. Other sites may accept mobile payments, such as Apple Pay or Google Pay, which allow consumers to make purchases using their mobile devices.

Ecommerce online payment systems also offer a range of additional features that can make the shopping experience more convenient for consumers. For example, many payment gateways allow customers to save their payment information for future purchases, making it easier to check out and pay for items. Some payment gateways also offer recurring payment options, which can be useful for subscription-based services or for businesses that need to charge customers on a regular basis.

Overall, ecommerce online payment systems have greatly improved the shopping experience for consumers and have made it easier for businesses to accept payments. These systems offer a range of options and features that make it easier and more convenient for consumers to make purchases, and they also help to ensure the security of payment transactions. As a result, ecommerce online payment systems are likely to continue to play a central role in the growth of ecommerce in the coming years.