Disposable income is a key concept in economics that refers to the amount of money that households have available to spend or save after accounting for taxes and other necessary expenses. It is an important indicator of economic well-being and can have significant impacts on consumer spending and the overall economy.

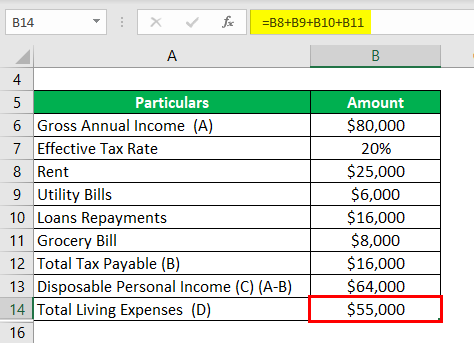

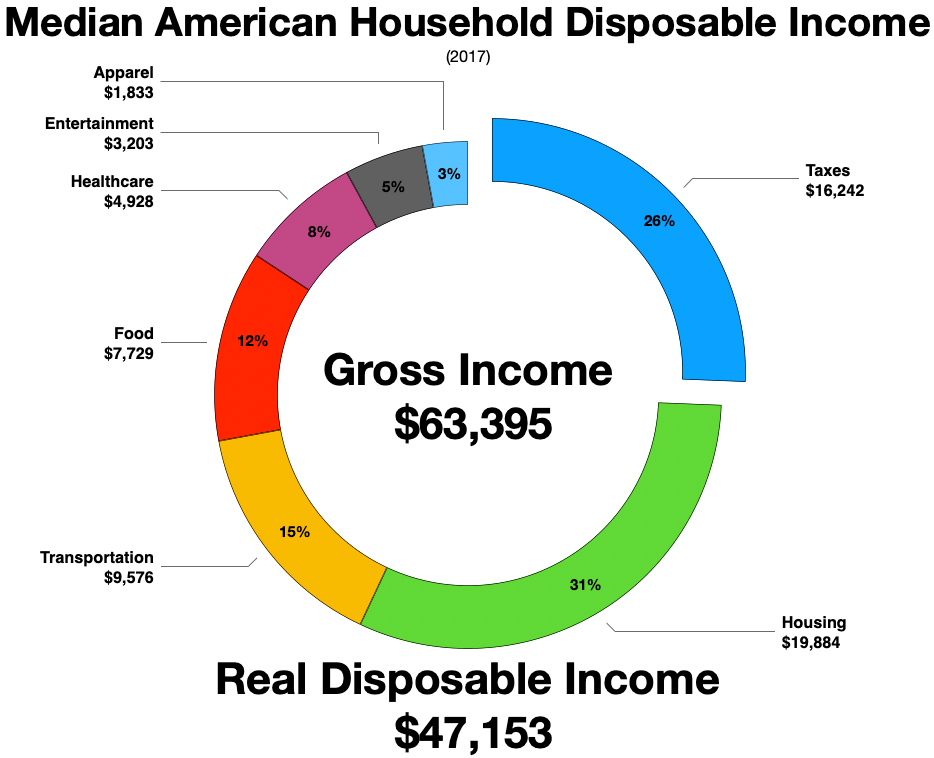

Disposable income is calculated by taking a household's total income and subtracting out taxes and other mandatory expenses, such as insurance and retirement contributions. For example, if a household has an annual income of $50,000 and pays $10,000 in taxes and $5,000 in mandatory expenses, their disposable income would be $35,000.

Disposable income is important because it represents the amount of money that households have available to spend on goods and services, which drives consumer demand and ultimately drives economic growth. When disposable income is high, consumers are more likely to spend money on goods and services, which can lead to increased sales for businesses and higher levels of economic activity. Conversely, when disposable income is low, consumers are more likely to save money or pay down debt, which can lead to slower economic growth.

There are several factors that can impact disposable income, including changes in income levels, taxes, and mandatory expenses. For example, if a household experiences an increase in income, their disposable income will also increase, allowing them to potentially increase their spending. On the other hand, if a household experiences an increase in taxes or mandatory expenses, their disposable income will decrease, potentially leading to a decrease in spending.

Policymakers and economists often pay close attention to disposable income as a measure of economic well-being and as a way to gauge the strength of the economy. For example, during economic downturns, disposable income may decrease as unemployment rises and income levels fall. This can lead to a decrease in consumer spending, which can further exacerbate economic problems.

In summary, disposable income is a critical concept in economics that represents the amount of money that households have available to spend or save after accounting for taxes and other necessary expenses. It is closely tied to consumer spending and economic growth, and is affected by a variety of factors including income levels, taxes, and mandatory expenses.

:max_bytes(150000):strip_icc()/consumer-spending-definition-and-determinants-3305917_color-97ebeaf3c72f452eae6bf3e91cd4cc88.png)