Disinvestment, also known as divestment, is a term used in economics to refer to the act of selling off assets or investments, such as stocks, bonds, or real estate. It is typically done for a variety of reasons, including financial, ethical, or strategic considerations.

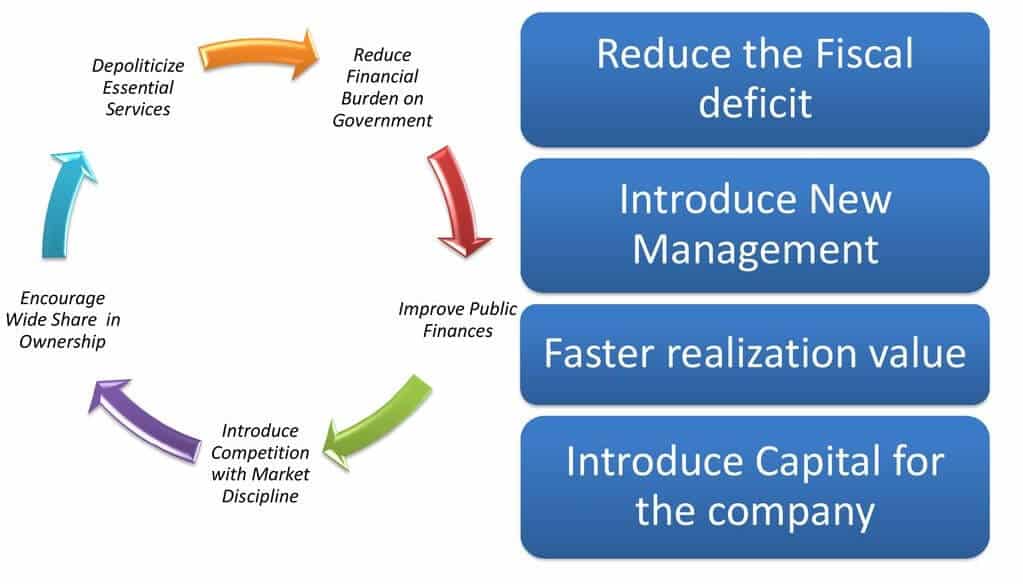

In the financial sense, disinvestment may be necessary when an investment is no longer profitable or is expected to generate lower returns in the future. For example, a company may decide to disinvest in a particular division or product line that is underperforming, in order to redirect its resources towards more promising ventures. Similarly, an individual investor may disinvest in a stock that has declined in value or is no longer considered a good investment.

Disinvestment can also be motivated by ethical or social concerns. For instance, a company or individual may decide to disinvest in a particular industry or company due to concerns about environmental degradation, labor practices, or other social issues. This type of disinvestment is often referred to as "socially responsible investing."

Strategic disinvestment may be undertaken in order to reshape the portfolio of a company or individual, or to raise capital for other purposes. For example, a company may sell off non-core assets in order to focus on its core business, or to raise funds for expansion or other purposes. Similarly, an individual investor may disinvest in a particular asset in order to diversify their portfolio or to raise cash for other investment opportunities.

Disinvestment can have significant economic consequences, both for the entity disinvesting and for the economy as a whole. For example, the sale of a major asset by a company may result in job losses and other economic disruption, while the divestment of a large amount of capital by investors may lead to market instability or other economic impacts.

In summary, disinvestment refers to the act of selling off assets or investments, and can be motivated by financial, ethical, or strategic considerations. While disinvestment can have significant economic consequences, it can also be a necessary step in the process of restructuring or redirecting resources towards more promising opportunities.