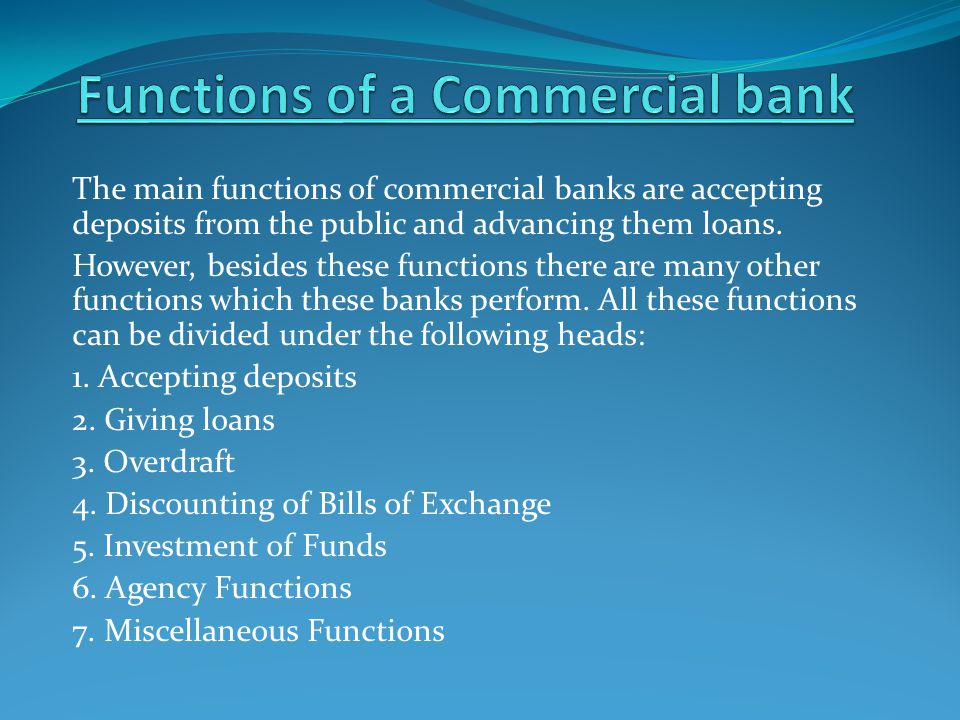

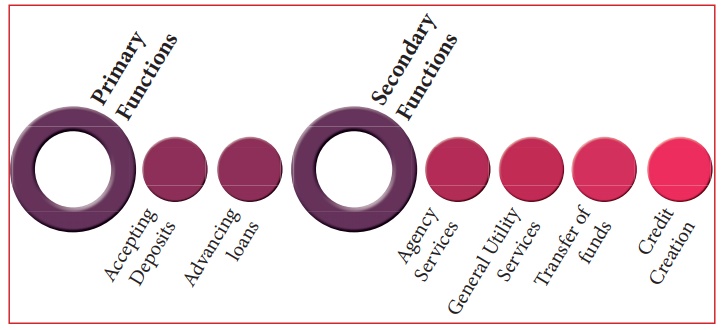

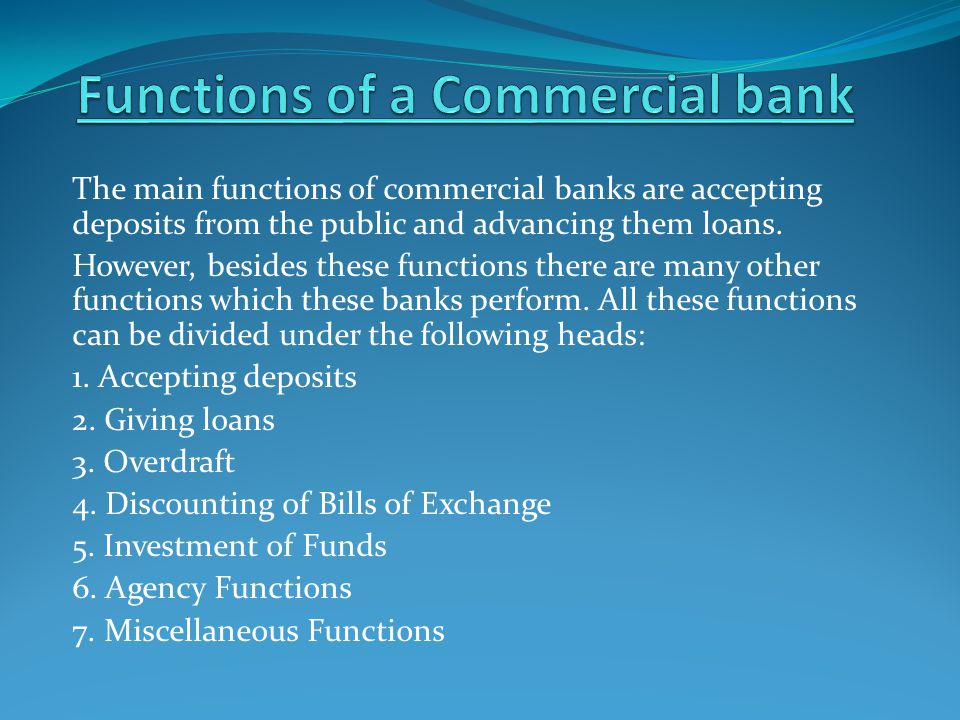

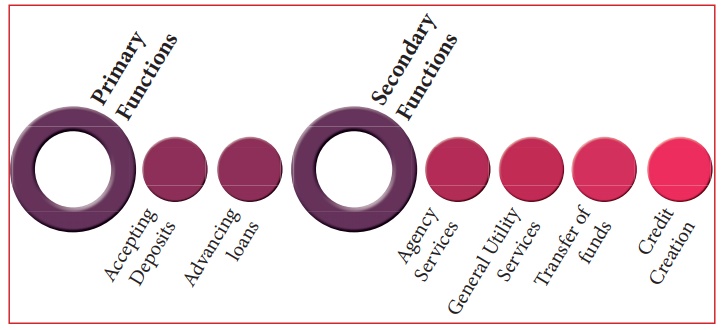

A commercial bank is a financial institution that provides a range of financial services to individuals, small and medium-sized businesses, and large corporations. The primary function of a commercial bank is to accept deposits from customers and use those deposits to lend money to borrowers. This lending activity is what generates the majority of a commercial bank's profits.

One of the primary ways that a commercial bank generates income is through the interest it charges on loans. When a bank grants a loan to a borrower, it typically charges an interest rate on the loan amount. This interest rate is determined by a variety of factors, including the creditworthiness of the borrower, the current market conditions, and the bank's own risk tolerance. The interest that a commercial bank charges on loans is how it makes money and is a key source of income for the bank.

In addition to lending, commercial banks also offer a range of other financial services to their customers. These services may include the issuance of credit cards, the underwriting of mortgages, the processing of electronic payments, and the provision of investment and wealth management services.

Another important function of commercial banks is to act as a financial intermediary. This means that they act as a go-between for borrowers and lenders, connecting those who have surplus funds to lend with those who need funds to borrow. By acting as an intermediary, commercial banks help to ensure that the flow of credit and capital within an economy is smooth and efficient.

Finally, commercial banks also play a vital role in facilitating the smooth functioning of the economy by providing a safe and secure place for individuals and businesses to store their money. By offering deposit accounts such as checking and savings accounts, commercial banks allow their customers to easily and conveniently access their funds when needed.

In summary, the main function of a commercial bank is to lend money to borrowers and generate income through the interest it charges on loans. However, commercial banks also offer a range of other financial services to their customers and play a crucial role in facilitating the flow of credit and capital within an economy.

The Role of Commercial Banks in the Economy

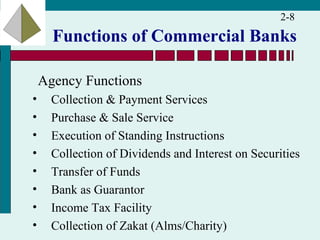

However, there are also difficulties in this process: classmates in the university are younger, it is more difficult to establish contact with them; During the training in the college, theoretical knowledge is forgotten for some basic subjects that are studied in depth at the first courses of the university chemistry, physics, mathematics, history, etc. Creating the Vision Once the board and management are set, a location is selected and the overall vision for the bank is created. When the borrowers repay, the banks make money through the interest earned, and they pay depositors some interest on their deposited money. Banks that do both jobs will go on to be successes. They get passports, travelers tickets, book vehicles, plots for their customers and receive letters on their behalf.

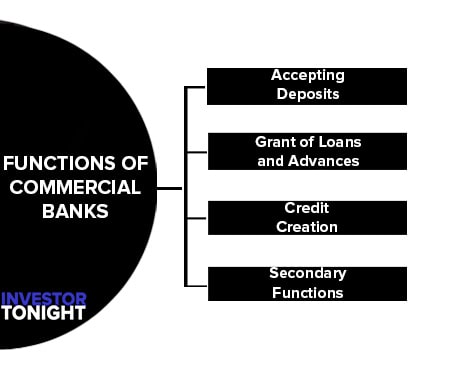

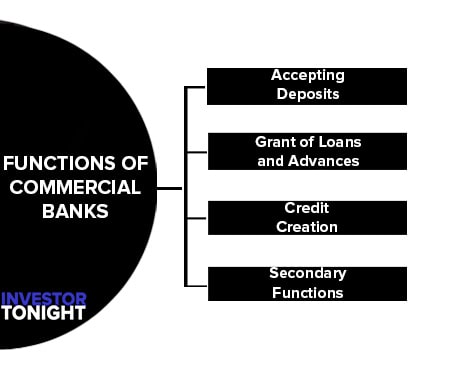

Commercial Bank: Definition, Function, Credit Creation and Significances

Credit Money Creation by Commercial Banks A10; D10, 10C, 11, 11C : RBI produces money while commercial banks increase the supply of money by creating credit which is also treated as money creation. People deposits big and small savings in various accounts with banks. Purchasing and sales of Securities: Banks undertake purchase and sale of various securities like shares, stocks, bonds, debentures etc. Banks provide safety vaults and lockers to their customers for safe custody of their valuable articles and documents. Mind, all financial institutions are not commercial banks because only those which perform dual functions of i accepting deposits and ii giving loans are termed as commercial banks. The depositor deposits his money with the bank for a fixed period. Commercial Banks and the Big Picture The process of launching a commercial bank foreshadows the overall role that these banks play in the economy.

What is the function of commercial Banks or Modern banks

People consider it more rational to deposit their savings in a bank because by doing so they, on the one hand, earn interest, and on the other, avoid the danger of theft. Banks have the ability to create credit many times more than their deposits and this ability of multiple credit creation depends upon the cash-reserve ratio of the banks. Periodically, the safe is taken to the bank where the amount of safe is credited to his account. Commercial banking is a group of entities whose economic activity is financial intermediation. It is well known for its diversity in the provision of comprehensive financial services like corporate and investment banking and consumer banking. The specialist knows what is happening at each level: who, what, and why is engaged in a particular case. B Agency Functions: Banks are also agents of their customers.

Functions of Commercial Banks (5 Answers)

ADVERTISEMENTS: ii Cash Credit: It is a type of loan, which is given to the borrower against his current assets, such as shares, stocks, bonds, etc. Customers can deposit funds and withdraw on short notice for their own use. While commercial banks have traditionally provided services to individuals and businesses, investment banking offers banking services to large companies and institutional investors. Deposits in this account cannot be withdrawn before the maturity period for which they have been contracted. A cheque book is given to the account holder to with draw his money.