Variable costing, also known as direct costing or marginal costing, is a method of costing that only includes variable production costs in the cost of a product. Fixed costs, such as rent, salaries, and insurance, are not included in the calculation of the cost of a product under variable costing. While variable costing has some advantages, it also has several disadvantages that make it less suitable for certain situations.

One of the main disadvantages of variable costing is that it does not accurately reflect the total cost of producing a product. By excluding fixed costs from the calculation, the cost of a product under variable costing will be lower than the actual cost of production. This can lead to decision-making errors if a company relies on variable costing to determine the price of its products or to assess the profitability of different products or product lines.

Another disadvantage of variable costing is that it can distort the financial performance of a company. Since fixed costs are not included in the calculation of product costs, the profit or loss of a product or product line may appear to be higher or lower than it actually is. This can lead to a misleading interpretation of the company's financial performance and may cause management to make inappropriate decisions based on incorrect information.

Furthermore, variable costing does not provide a complete picture of a company's financial situation. By only considering variable costs, it fails to take into account the long-term financial implications of fixed costs, such as the need to replace equipment or renew leases. This can lead to a lack of transparency and make it difficult for stakeholders, such as investors and creditors, to fully understand the financial health of the company.

In addition, variable costing may not be suitable for companies that have a high proportion of fixed costs in their cost structure. For example, a manufacturing company with a large factory and a significant number of employees may have a high proportion of fixed costs. In this case, variable costing may not accurately reflect the true cost of production and may lead to incorrect pricing decisions.

In conclusion, while variable costing has some advantages, such as its simplicity and its ability to highlight the impact of changes in variable costs on profitability, it also has several disadvantages. It does not accurately reflect the total cost of production, can distort the financial performance of a company, and may not provide a complete picture of a company's financial situation. As a result, it may not be the best method of costing for all companies and situations.

Advantages and Disadvantages of Marginal Costing

Businesses may use it to manage expenses, find areas where they can cut expenditures, and arrive at wise judgments. The variable costing includes only variable manufacturing costs, which varies with change in the volume of production, in the cost of product and thus makes variable manufacturing costs controllable at cost centre level by operating management. In some businesses, engineering standards are being replaced by either a very difficult target cost or a rolling average of real costs, which is supposed to decrease. The identification and classification of costs as either fixed or variable, with semi-variable expenses properly subdivided into this fixed and variable components, provide useful framework for the accumulation and analysis of costs and further for making decisions. The principle states that expenses should be recognized in the period in which revenues are incurred. The management can take decision regarding pricing and tendering. Simplification of Overheads: It reduces the degree of over- or under-recovery of overheads due to separation of fixed overheads from production cost.

Variable Costing: Advantages, Disadvantages, and Examples

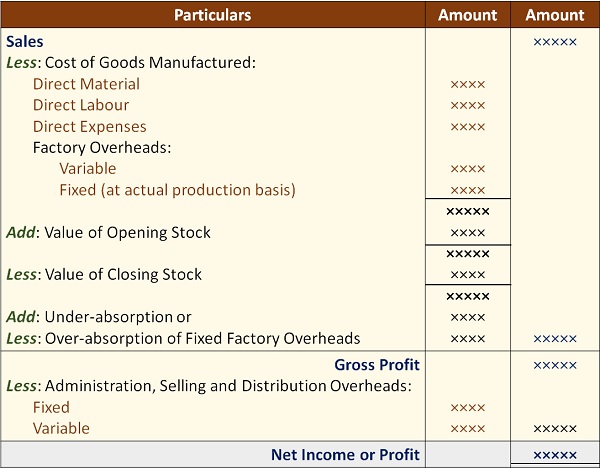

When a company sells the same quantity of products produced during the period, the resulting net income will be identical whether absorption costing or variable costing is used. Fixed production costs are charged to the period in which they are incurred and are not carried forward in stock which may be un-saleable, resulting in earlier profits being overstated. As previously stated, there are three parts of the business cycle: production, distribution, and sales or consumption, specifical sales to consumers. But they are not all controllable at the same level of management. Management might not be aware that the firm's standard expenses need to alter as a result of market developments until it is too late and the company has already lost money. When public utility concerns adopt marginal cost pricing, it helps in maximizing social welfare. The product is not complete until it is in a form and place and at a time desired by the customer, and this product completion involves distribution just as essential as it does manufacturing.

The ABC Costing Method: Advantages & Disadvantages › Insightvity

For example, if you manufacture t-shirts and use cotton as your main material, then cotton will be classified under Level 1. Performance Evaluation of Managers : The evaluation of managers is often linked with the profitability of units they manage and control. Cost Control efficiency: It fractionates the cost into fixed and variable. Even if a company must use absorption costing for its external reports, a manager can use variable costing statements for internal reports. For instance, the marginal cost of two jobs may be identical, but if one job takes twice as long to complete as the ether, the true cost of job taking longer time is higher than that of the other. The fixed manufacturing costs are reported as separate item in the variable costing income statement, they are easier to identify and control by a higher level of management than when they are spread among units of product as in absorption costing.

:max_bytes(150000):strip_icc()/vairablecost_definition_v1_0720-43dd01e64205438296a677d8860c6064.png)