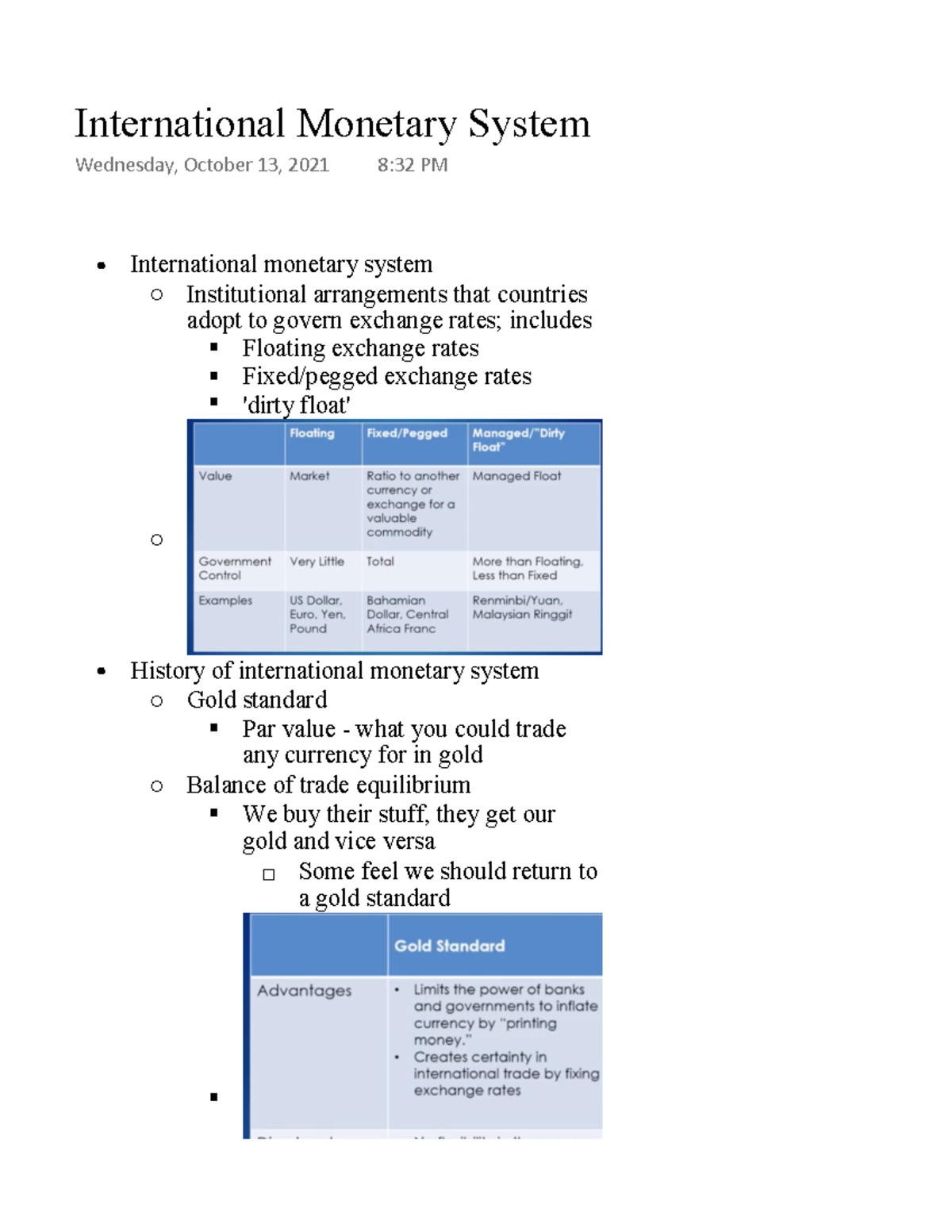

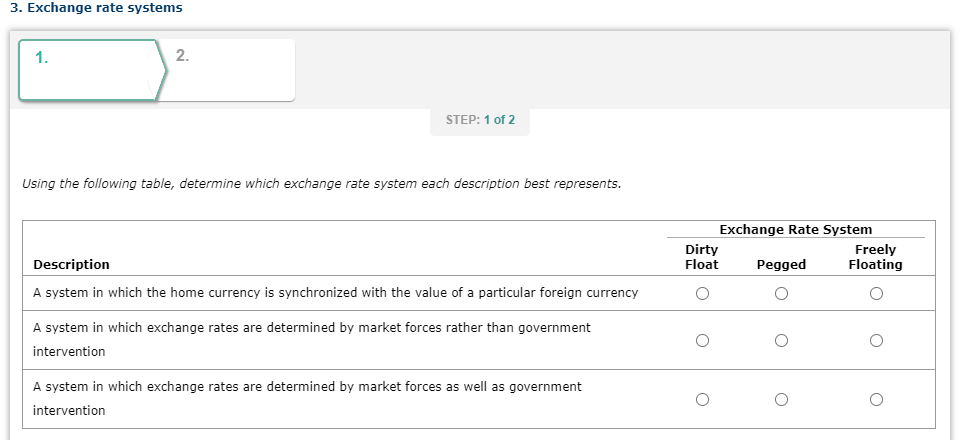

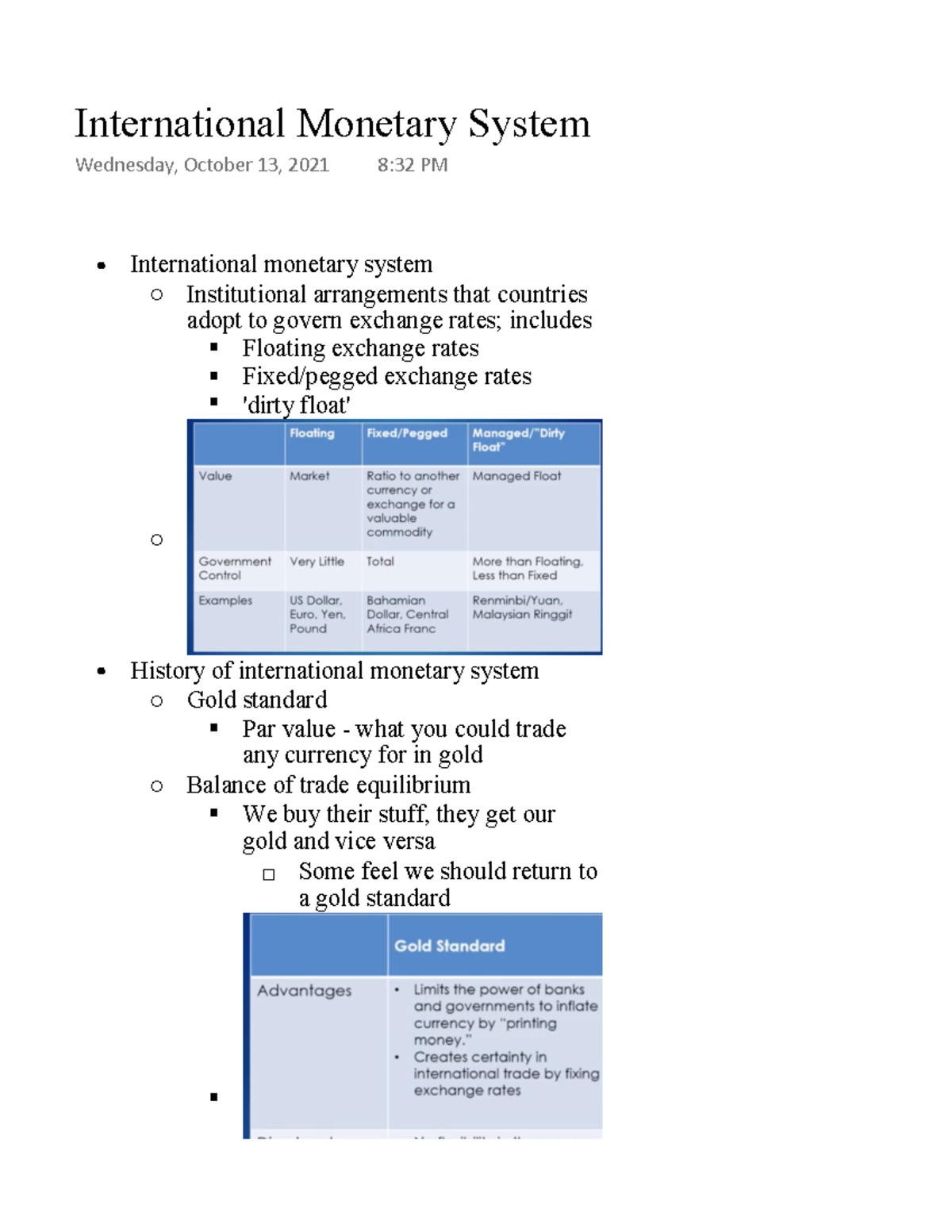

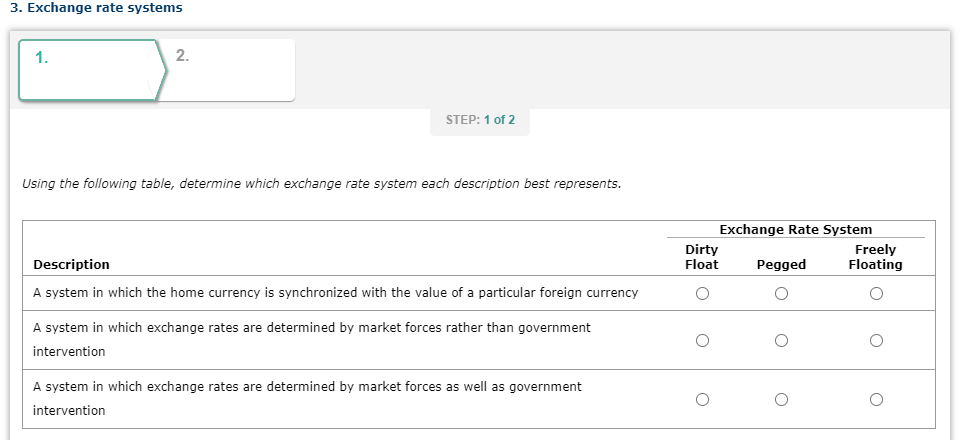

A dirty float is a type of exchange rate system in which the value of a country's currency is allowed to fluctuate within a certain range, but the central bank or government can intervene in the market to buy or sell currency in order to stabilize the value and prevent extreme fluctuations. This type of exchange rate system is also known as a managed float or a hybrid exchange rate system.

The main advantage of a dirty float is that it allows a country to maintain some control over the value of its currency while still allowing it to float freely in the market. This can help to reduce the impact of external economic shocks on the domestic economy, as the central bank can intervene to stabilize the currency if necessary.

However, there are also some disadvantages to a dirty float exchange rate system. One potential problem is that the central bank may not always have the necessary resources to intervene in the market, which could lead to a loss of credibility and a loss of faith in the currency. In addition, the central bank may be perceived as being biased in favor of certain industries or sectors, which could lead to unfair competition and distort the economy.

Another potential issue with a dirty float is that it can create uncertainty for investors and businesses, as it is not always clear when the central bank will intervene or how much it will buy or sell. This can make it difficult for businesses to plan and make long-term investments, as they may not know how the value of the currency will change in the future.

Overall, a dirty float exchange rate system can be a useful tool for managing the value of a country's currency, but it is important for the central bank to be transparent and consistent in its actions in order to maintain credibility and stability in the market.

Dirty float

This in turn would lower the risk of deflationary recession manifold. How is a fixed exchange rate maintained? While that is surely important, along with sound money management habits, to navigating the markets; that step alone does not represent the full preparation. The agent's working capital and clients funded account have to be separated. Out of the two currencies which are considered, the weaker currency is pegged with the stronger currency by either the government or the central bank of the domestic country through the purchase of foreign exchange. .

Dirty Float

By contrast, a fixed exchange rate is set by the government, usually by pinning the value of the currency to the value of a currency unit such as the United States dollar. Rather, the value of the currency is kept in a range against another currency or against a basket of currencies by central bank intervention. To understand the concept of a managed floating exchange rate system, you have to understand what exchange rates are and how they function. A letter of credit providing for settlement more than nine months from shipment of the goods is normally in t. The actual costs of pilotage are computed in terms of pilotage units read this and related legal terms for further detail. . Since the Central Bank and the Government work in tandem, there are little chances of differences in opinion at the very top.

What is clean and dirty float?

It must be remembered that such a regime allows a high amount of autonomy to market forces to correct themselves, and the economy by extension. If this is breached, both the Govt and the RBI will step in for corrective measures. How exactly does the bank come into the picture? When investing and dealing with brokers customer support can be a range of customer services to assist customers in making cost effective and correct use the brokers services. For advanced students, it will be interesting to note that fixed and managed regimes share some disadvantages. Floating currency exchange rates pros vs.

:max_bytes(150000):strip_icc()/dotdash-floatingexchangerate-FINAL-d2e0c610285d484eb8c88396e78c6a6d.jpg)