Revenue and expenditure are two financial terms that are often used in business and economics. They are both related to the financial transactions of a company or organization, but they refer to different aspects of those transactions. Understanding the difference between revenue and expenditure is important for anyone who is interested in the financial health and performance of a business or organization.

Revenue refers to the money that a company or organization receives from its various sources of income. This can include money from the sale of goods or services, rent or lease payments, and investment income. Revenue is typically recorded on a company's income statement, which is a financial document that shows the company's financial performance over a given period of time.

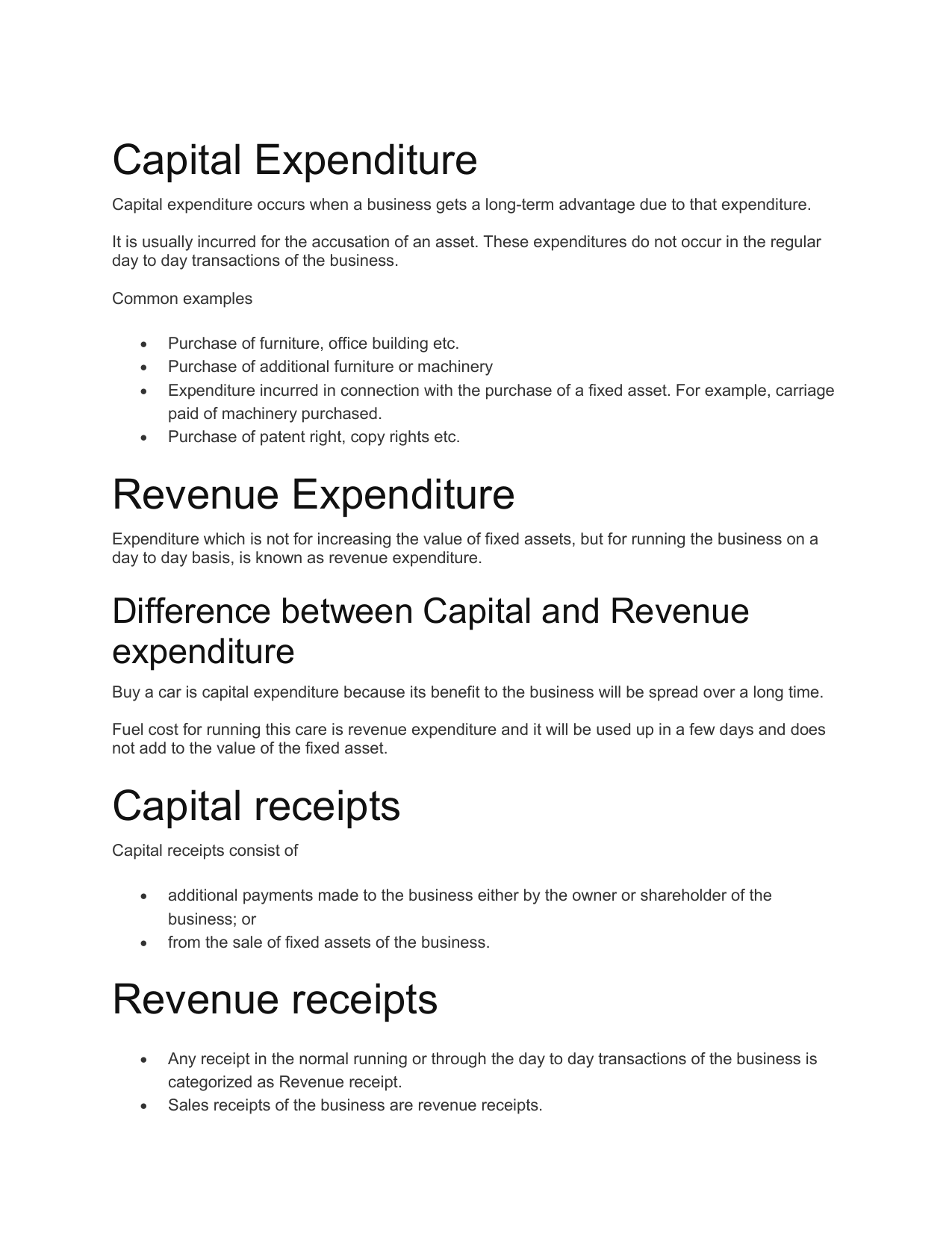

On the other hand, expenditure refers to the money that a company or organization spends on its various expenses. This can include costs associated with the production of goods or services, such as raw materials, labor, and utilities. It can also include expenses related to the operation of the business, such as rent, salaries, and insurance. Like revenue, expenditure is typically recorded on a company's income statement.

One way to think about the difference between revenue and expenditure is to consider them as opposite sides of the same coin. Revenue represents the inflow of money into a company or organization, while expenditure represents the outflow of money. By comparing the two, it is possible to get a sense of the overall financial health of a business or organization.

For example, if a company's revenue is greater than its expenditure, it is likely to be in a strong financial position. This means that the company is generating more money than it is spending, which can lead to profits and growth. On the other hand, if a company's expenditure is greater than its revenue, it is likely to be in a weak financial position. This means that the company is spending more money than it is generating, which can lead to financial difficulties and potentially even bankruptcy.

In conclusion, revenue and expenditure are two important financial terms that refer to the money that a company or organization receives and spends, respectively. Understanding the difference between the two is crucial for anyone interested in the financial health and performance of a business or organization. By comparing revenue and expenditure, it is possible to get a sense of the overall financial position of a company and identify potential areas for improvement.

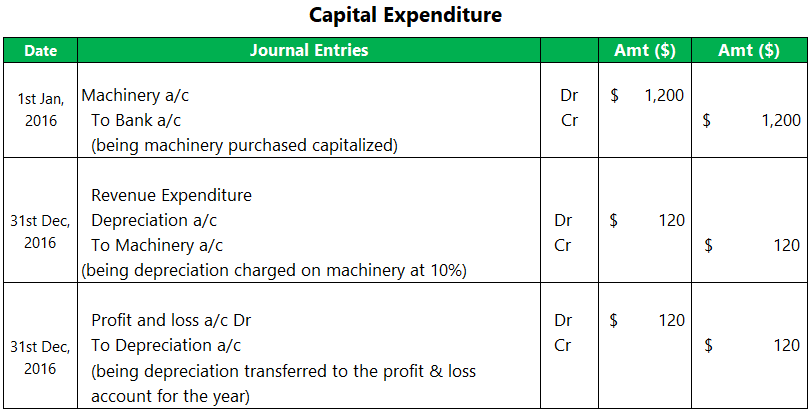

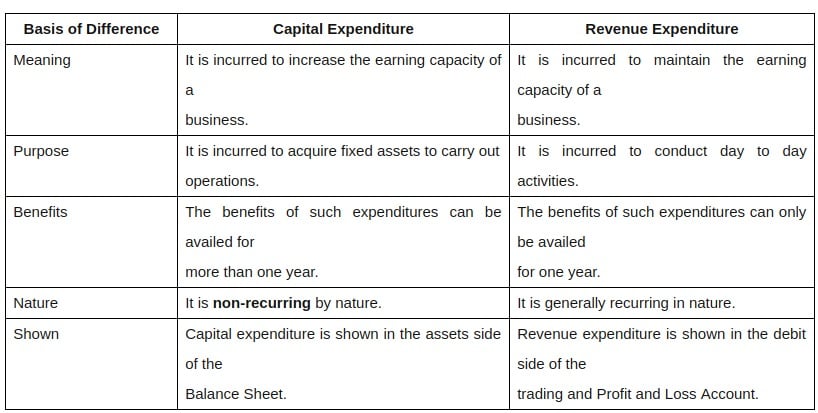

Top 9 Difference Between Capital Expenditure and Revenue Expenditure

Keeping aside profit in the form of retained earnings or reserves ultimately reduces the amount of profit available for distribution among the shareholders of the business. Rather, it reduces the amount of divisible profits. Standard of living Generally Higher Comparatively Lower Distribution of Income Equal Unequal Factors of Production Effectively utilized Ineffectively utilized Definition of Developed Countries Developed Countries are the countries which are developed in terms of economy and industrialization. These receipts are a part of normal business operations that is why they occur again and again however its benefit can be enjoyed only in the current accounting year as its effect is short term. Capital Expenditure, also referred to as CapEx, is the funds used by a company, firm, enterprise or an organisation to acquire, upgrade and maintain its fixed assets. There are two types of organization structure, that can be formal organization and informal organization.

Difference Between Forecasting and Planning (with Comparison Chart)

As against, the accounting conventions focus on the preparation and presentation of financial statements. For example, the amount spent on purchase of stock-in-trade is of revenue nature. If it acquires stock-in-trade, then it is revenue expenditure. High infant mortality rate, death rate and birth rate, along with low life expectancy rate. Revenue expenditure is expired cost. Living conditions Good Moderate Generates more revenue from Industrial sector Service sector Growth High industrial growth. Although, as per Transfer of Reserve Rules, joint stock companies need to create the specified amount of reserves out of profit.

Difference Between Formal and Informal Organization

Further, an alternative name for these reserves is free reserves. But not only the resources, but a manager is in charge of the entire management of the organization. Managers are the ones who control and administer the entire enterprise, On the other hand, Supervisor is someone who is the leader in the first line management of the organization and thus looks after the work and performance of the employees. However, they involve an opportunity cost. Conversely, accounting conventions imply procedures and principles that are generally accepted by the accounting bodies and adopted by the firm to guide at the time of preparing the financial statement. Moreover, the primary aim of creating reserve is to strengthen the financial status of the company for its perpetual succession in future years.