Budgetary control is a management technique that involves setting financial targets for an organization and then comparing actual performance against those targets. It is a key tool used by organizations to plan and monitor their financial performance, and it is essential for maintaining financial stability and achieving long-term goals.

There are several essential features of budgetary control that are worth highlighting.

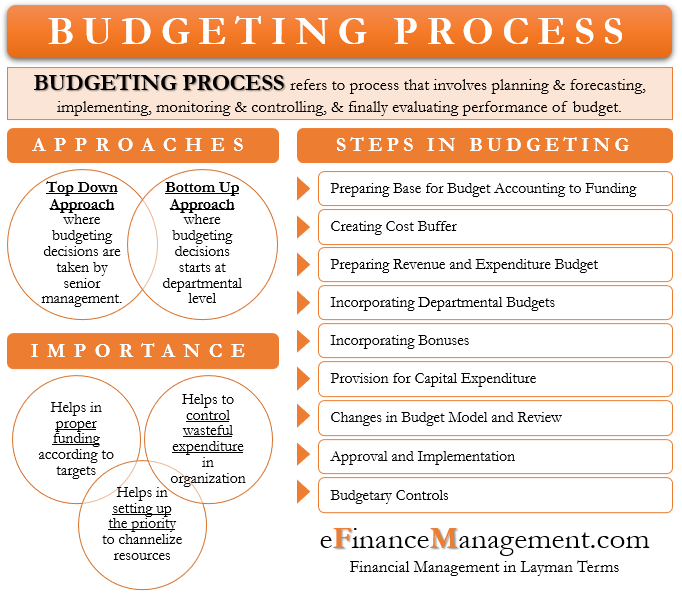

First, it involves the preparation of a budget. A budget is a detailed financial plan that outlines the expected expenses and revenues for a specific period of time, such as a fiscal year. It is a crucial tool for forecasting future financial performance and helps organizations allocate resources effectively. Budgeting requires careful planning and analysis to ensure that the budget is realistic and achievable.

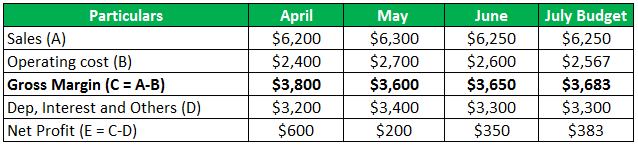

Second, it involves the comparison of actual performance against the budget. This comparison helps organizations identify deviations from the budget and take corrective action if necessary. For example, if actual expenses are higher than expected, the organization may need to find ways to reduce costs or increase revenue. This continuous monitoring and evaluation of financial performance is essential for making informed decisions and achieving financial goals.

Third, it involves the implementation of corrective action. If there are significant deviations from the budget, it is important for organizations to take timely and effective corrective action. This may involve revising the budget, implementing cost-cutting measures, or taking other steps to get back on track. By doing so, organizations can maintain financial stability and achieve their long-term goals.

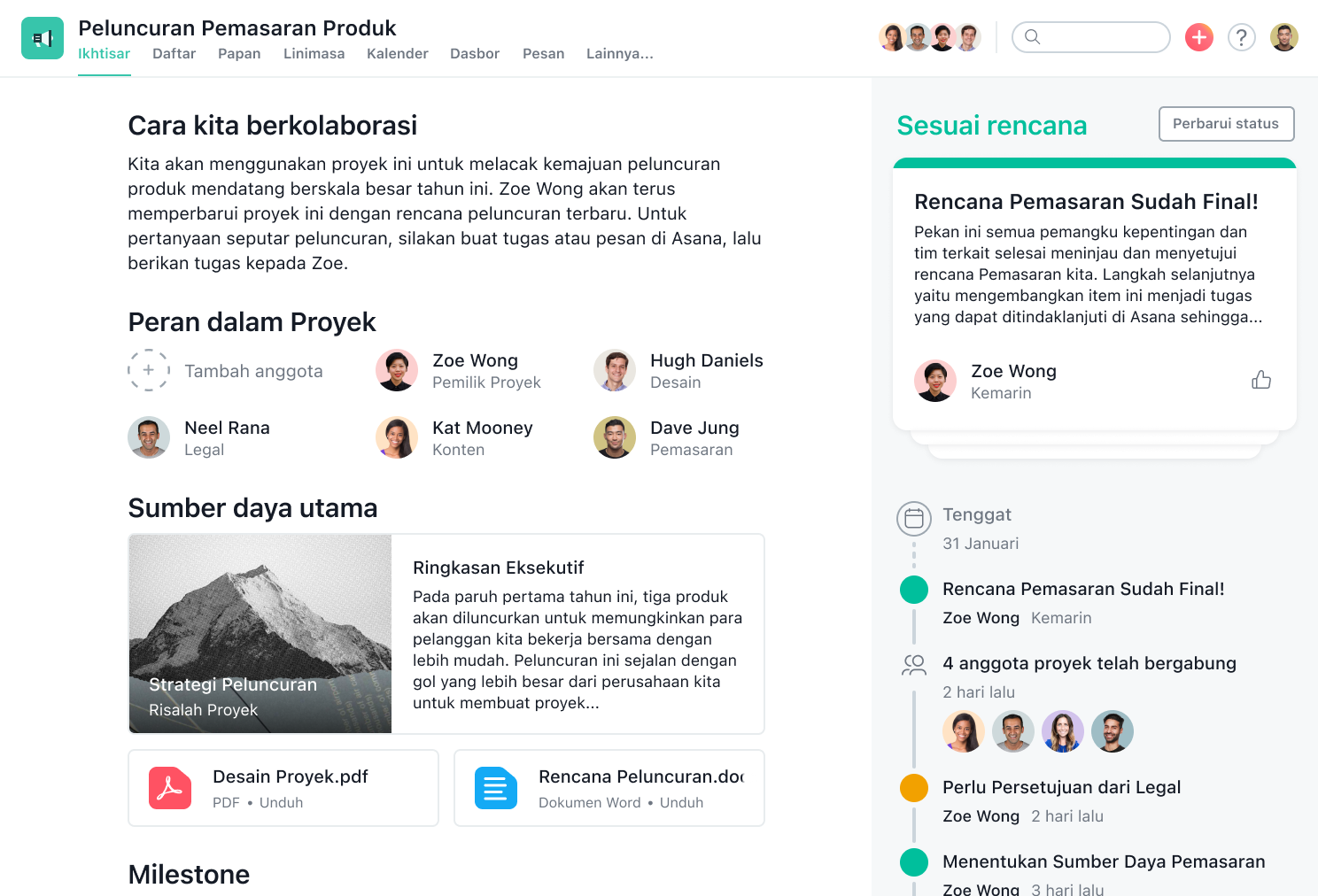

Fourth, it involves effective communication and collaboration. Budgetary control requires the involvement of all levels of the organization, from top management to front-line employees. It is important for everyone to be aware of the budget and their role in achieving it, and for there to be effective communication and collaboration across all levels of the organization.

In summary, budgetary control is an essential management technique that involves setting financial targets, comparing actual performance against those targets, implementing corrective action as needed, and effective communication and collaboration. It is a crucial tool for maintaining financial stability and achieving long-term goals.

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)