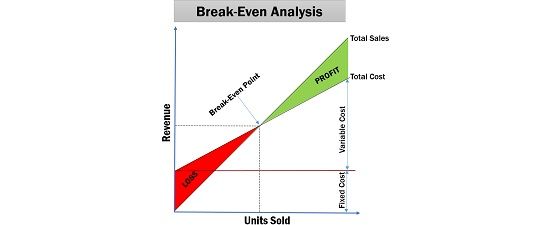

Break-even analysis is a financial tool used to determine the point at which a business will begin to generate a profit. It is used to determine the minimum level of sales or production that must be achieved in order to cover all of the costs associated with running the business.

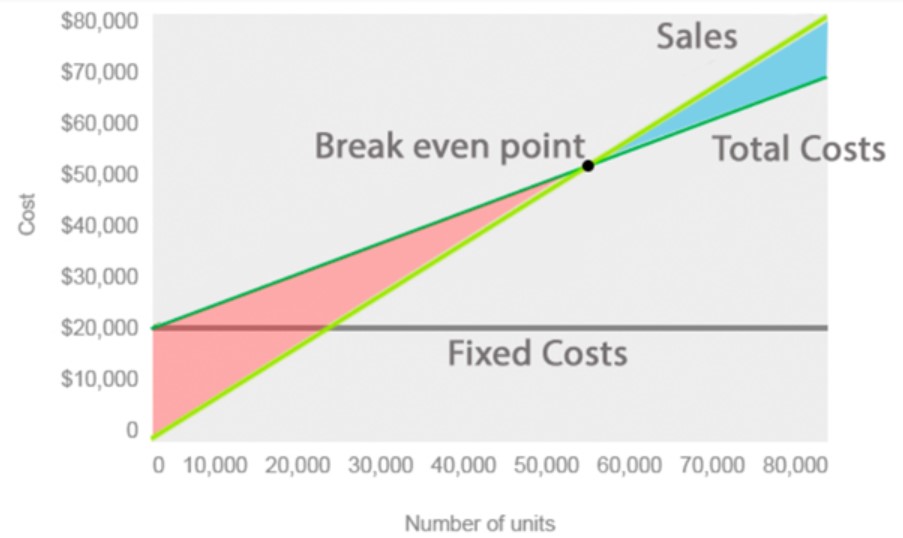

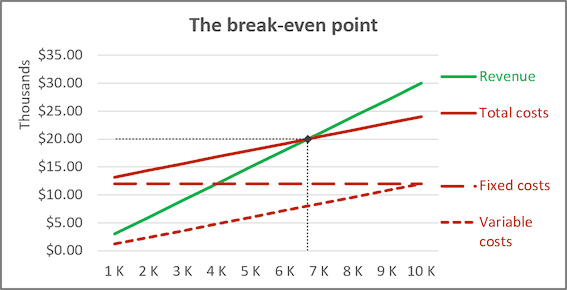

To conduct a break-even analysis, a business must first identify all of its fixed costs, which are expenses that do not vary with changes in production or sales. These costs may include rent, salaries, and insurance, for example. The business must then determine its variable costs, which are expenses that change with the level of production or sales. These costs may include the cost of materials, labor, and utilities.

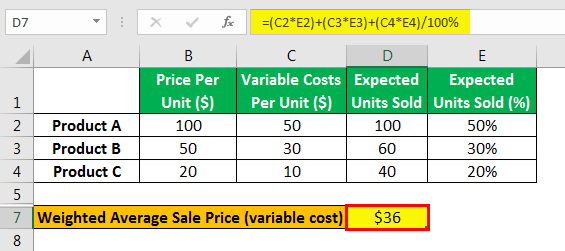

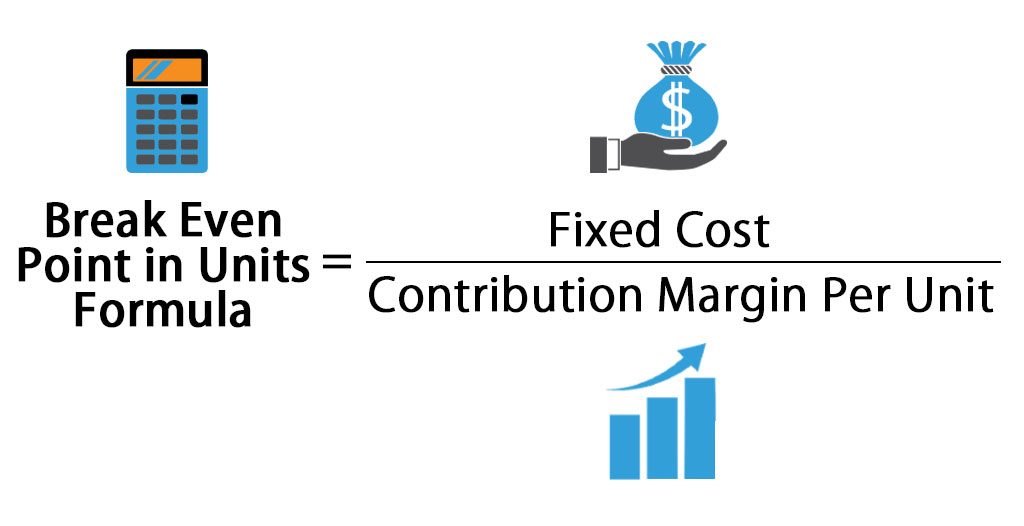

Once the fixed and variable costs have been identified, the business can calculate its break-even point by dividing the total fixed costs by the difference between the unit price of the product or service and the unit variable cost. This calculation will yield the number of units that must be sold in order to break even.

For example, if a business has fixed costs of $100,000 per year and a unit price of $10 with a unit variable cost of $5, the break-even point would be 20,000 units. This means that the business must sell at least 20,000 units in order to cover all of its costs and begin to generate a profit.

Break-even analysis is useful for a number of reasons. First, it helps businesses to understand the minimum level of sales or production that they must achieve in order to be financially successful. This can be especially useful for businesses that are just starting out, as it can help them to set realistic goals and plan for the future.

Second, break-even analysis can help businesses to identify potential problems or bottlenecks in their operations. For example, if a business is consistently failing to reach its break-even point, it may be a sign that the business is not operating efficiently or that the unit price or unit variable cost is too high. By identifying these issues, businesses can take steps to improve their operations and increase their chances of success.

Finally, break-even analysis can help businesses to make informed decisions about pricing and production. For example, if a business is considering increasing the price of its product, it can use break-even analysis to determine the impact this would have on its bottom line. Similarly, if a business is considering increasing its production levels, it can use break-even analysis to determine the additional costs that this would incur and whether it would be financially viable.

In conclusion, break-even analysis is a valuable tool that helps businesses to understand the minimum level of sales or production required to cover their costs and generate a profit. By conducting a break-even analysis, businesses can set realistic goals, identify potential problems, and make informed decisions about pricing and production.