Cost-volume analysis is a managerial accounting technique that helps businesses understand the relationship between cost, volume, and profit. It is an important tool for managers to make informed decisions about pricing, production, and cost-cutting measures.

The cost-volume-profit (CVP) analysis assumes that there is a linear relationship between cost, volume, and profit. This means that as the volume of products or services increases, the total cost also increases, but at a decreasing rate. On the other hand, as the volume decreases, the total cost increases at an increasing rate.

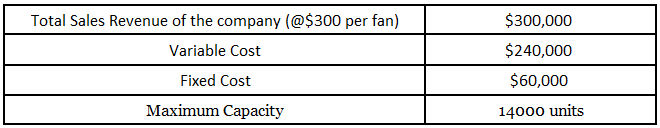

To understand this relationship, it is important to distinguish between fixed costs and variable costs. Fixed costs are those that remain constant regardless of the volume of production, such as rent and salaries. On the other hand, variable costs are those that vary with the volume of production, such as raw materials and labor.

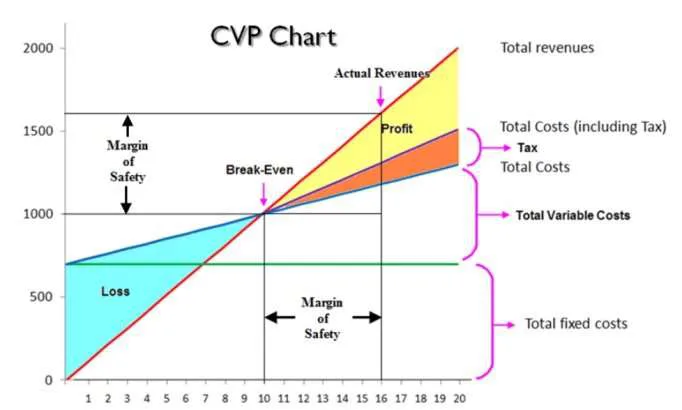

Using CVP analysis, managers can calculate the break-even point, which is the point at which the total cost is equal to the total revenue. At the break-even point, the business is neither making a profit nor a loss. By understanding the break-even point, managers can set pricing and production levels to ensure that the business is operating at a profit.

CVP analysis can also be used to determine the optimal pricing and production levels for a business. By understanding the relationship between cost, volume, and profit, managers can make informed decisions about how to price their products or services in order to maximize profits. For example, if the business is operating at a loss, the manager may decide to lower prices in order to increase volume and move the business closer to the break-even point.

In addition to pricing and production decisions, CVP analysis can also be used to identify cost-cutting opportunities. By understanding the relationship between cost and volume, managers can identify areas where costs can be reduced without negatively impacting the volume of production. For example, if a business is using a particularly expensive raw material, the manager may consider finding a cheaper alternative in order to reduce costs without impacting the volume of production.

In conclusion, cost-volume analysis is a valuable tool for managers to make informed decisions about pricing, production, and cost-cutting measures. By understanding the relationship between cost, volume, and profit, managers can optimize pricing and production levels to maximize profits and identify cost-cutting opportunities.