The cost of capital at Ameritrade is a key factor that the company must consider when making investment decisions. It represents the minimum rate of return that the company must earn on its investments in order to maintain the value of its shareholders' investments.

There are several components that make up the cost of capital at Ameritrade. The first is the cost of equity, which represents the rate of return that shareholders expect to receive on their investments. This can be calculated using the Capital Asset Pricing Model (CAPM), which takes into account the risk-free rate, the market risk premium, and the company's beta.

The second component is the cost of debt, which represents the rate of return that the company must pay on its borrowings. This can be calculated using the yield to maturity on the company's bonds or the interest rate on its loans.

The final component is the cost of preferred stock, which represents the rate of return that holders of preferred stock expect to receive on their investments.

To determine the overall cost of capital at Ameritrade, the company must weigh the relative proportions of equity, debt, and preferred stock in its capital structure and then calculate a weighted average of the cost of each component. This is known as the weighted average cost of capital (WACC).

The WACC is a critical input into the company's decision-making process, as it represents the required rate of return that the company must earn on its investments in order to generate value for its shareholders. If the company's investments do not generate returns that meet or exceed the WACC, then they may not be worth pursuing.

In conclusion, the cost of capital at Ameritrade is an important consideration that the company must take into account when making investment decisions. It represents the minimum rate of return that the company must earn in order to maintain the value of its shareholders' investments and generate value for the company. By understanding and carefully managing its cost of capital, Ameritrade can make informed decisions that maximize shareholder value.

COST OF CAPITAL AT AMERITRADE Case Solution And Analysis, HBR Case Study Solution & Analysis of Harvard Case Studies

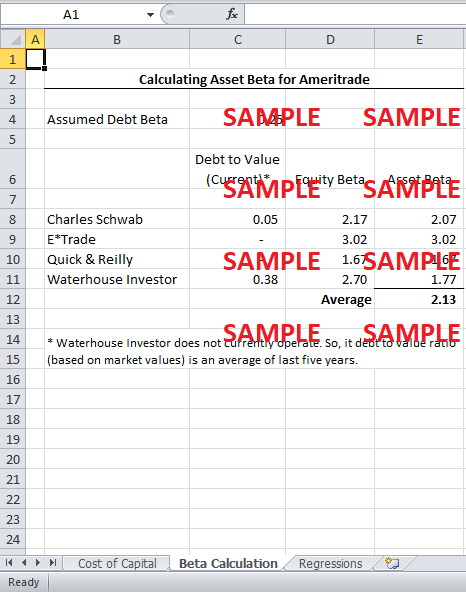

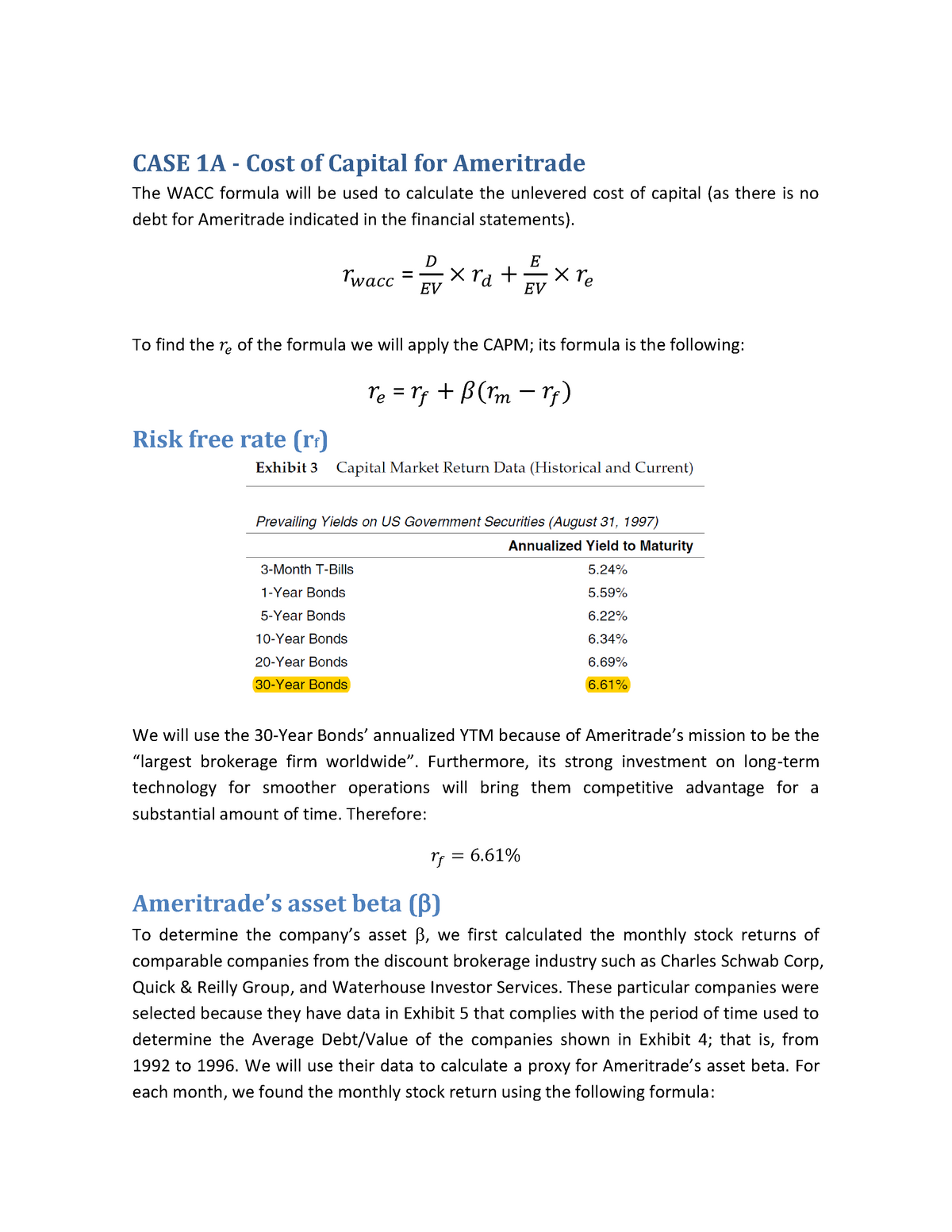

International Journal of Management Reviews, 20 2 , 184-205. In this method, the regression analysis of both the monthly returns x and the VW NYSE y is used to estimate the beta. International Journal of Modern Social Sciences, 2 1 , 34-43. Rare Cost of Capital at Ameritrade is one of the greatest company all inclusive. Estimates of Risk Free Rate and MRP When deciding about the risk free rate to be used, it is considered that the projects are for the long term in future therefore, long term and current rates should be used.

Case Solution for Cost of Capital at Ameritrade

If you read nothing else on strategy, read thesebest-selling articles. Corporate financial reporting and analysis: Text and cases. Therefore, the management should determine the cost of capital, which is required to evaluate the project. However, a majority of the products are sold directly to licensed sellers and shops locally as well as internationally. To consider a broader market, an average of large and small company stocks is taken for the risk premium. Cost of Capital at Ameritrade additionally incorporates information and detailed ingredients for its products to interest an assortment of clients. These are either to further develop the product, penetrate the market, develop the market, diversification, investing or divesting.

Ameritrade Company's Cost of Capital

Moreover, the historical average span over two different time-periods: 1950-1996 and 1929-1996. Recommendations to the CEO By averaging the Asset Betas of the comparable companies, and re-leveraging it with the debt to equity ratio of Ameritrade, a cost of equity of 22% is calculated. This includes the advertisement, public relations, personal selling, sales promotion, and direct marketing. The HBR case studies may present issues faced by a part of the organisation. Outbound logistics The company has contracted agents in offshore countries and sites to manage product selling. Therefore, the return on equities is usually taken as proxy for the return on market. One is also required to provide how these recommendations would be implemented.