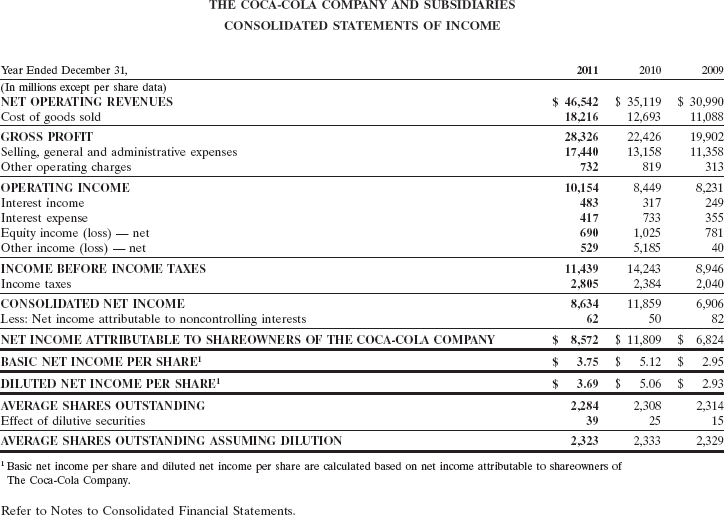

Coca-Cola is a multinational beverage company that is well-known for its iconic brand and wide range of products. In 2011, the company released its balance sheet, which provides an overview of the company's financial position at a specific point in time.

The balance sheet consists of two main sections: assets and liabilities. Assets are resources owned by the company, such as cash, investments, and property, while liabilities are obligations that the company owes to others, such as loans and accounts payable.

According to Coca-Cola's 2011 balance sheet, the company had total assets of $35.1 billion. This included $9.3 billion in cash and cash equivalents, $5.5 billion in investments, and $11.2 billion in property, plant, and equipment. The company also had $8.1 billion in intangible assets, such as trademarks and patents.

On the liability side of the balance sheet, Coca-Cola had total liabilities of $24.5 billion. This included $6.7 billion in long-term debt, $10.3 billion in accounts payable, and $3.3 billion in other liabilities. The company also had $4.2 billion in shareholder equity, which represents the residual value of the company after all debts have been paid.

Overall, Coca-Cola's 2011 balance sheet shows a strong financial position, with a significant amount of assets and a relatively low level of liabilities. This indicates that the company had a solid foundation to build upon and was well-positioned to continue growing and expanding its operations.

In conclusion, Coca-Cola's 2011 balance sheet highlights the company's financial strength and stability. The company had a strong mix of assets, including cash, investments, and property, as well as a relatively low level of liabilities. This financial position allowed Coca-Cola to continue building upon its success and establishing itself as a leading global beverage company.

Balance Sheet :: The Coca

Read also Sources Of Finances Available To A Business Finance Essay Other Assets At the time of preparation of balance sheet, there are conditions that the asset cannot be classified into any of the category such as investments, current assets, intangible assets or plant assets. This more than 200% change has shown that company has fairly utilized it extra cash to get some interest and monetary benefit. Financial Statements Balance Sheet Asset Current Assets Current assets usually include cash and some other type of assets that usually get converted into cash with normal course of time within an operating cycle. Also, differences between tax laws and accounting methods can result in a temporary difference in the amount of income tax payable by a company. This item includes treasury stock repurchased by the entity. Coca-Cola has, as can been through its Contingency liability Note snapshot, has contingency liability due to Guarantee to its third party customers. By breaking down trends over time using Coca Cola balance sheet statements, investors will see what precisely the company owns and what it owes to creditors or other parties at the end of each accounting year.

Coca

Trend Analysis of Coca-Cola of five year duration If we check out the performance of Coca-Cola over five years, we can say that on most of the parameters of Coca-cola is showing consistently downward trend. Major components are Current AssetsCurrent assets of Coca-Cola Co include cash, cash equivalents, short-term investments, accounts receivable, stock inventory and the portion of prepaid liabilities which will be paid within a year. Basic accounting convention shows to present the balance sheet in two major ways. Excludes cash and cash equivalents within disposal group and discontinued operation. Usually, in financial reporting, the term short-term and long-term is synonymous or interchangeable with the terms current and non-current items respectively.