A bill of exchange is a financial instrument that is used to facilitate payment between two parties. It is essentially a written order from one party (the drawer) to another party (the drawee) to pay a specific sum of money to a third party (the payee) at a future date, known as the due date. The calculation of the due date of a bill of exchange is a crucial aspect of this financial instrument, as it determines when the payment must be made.

There are several factors that can influence the calculation of the due date of a bill of exchange, including the terms of the bill itself, the local laws and regulations that apply to the transaction, and any relevant industry standards. In general, the due date of a bill of exchange is calculated based on the length of time between the date of the bill and the date on which the payment is due.

One of the most common methods for calculating the due date of a bill of exchange is known as the "usance period." This method involves calculating the number of days between the date of the bill and the due date, based on the terms of the bill and any relevant industry standards. For example, a bill that has a usance period of 30 days would be due 30 days after the date of the bill.

In some cases, the due date of a bill of exchange may be influenced by local laws and regulations. For example, some countries have laws that specify the maximum usance period that can be used for bills of exchange, which may affect the calculation of the due date. In other cases, the terms of the bill itself may specify a specific due date, regardless of the usance period.

It is important to carefully consider the due date of a bill of exchange, as failure to make payment on the due date can have serious consequences. The payee may be entitled to interest or other penalties if the payment is not made on time, and the drawer may damage their credit rating or incur other financial penalties if they are unable to make the payment.

In conclusion, the calculation of the due date of a bill of exchange is a crucial aspect of this financial instrument, as it determines when the payment must be made. It is important to carefully consider the terms of the bill and any relevant laws or regulations when calculating the due date, to ensure that the payment is made on time and to avoid any potential consequences.

Bill of Exchanged Definition: Examples and How It Works

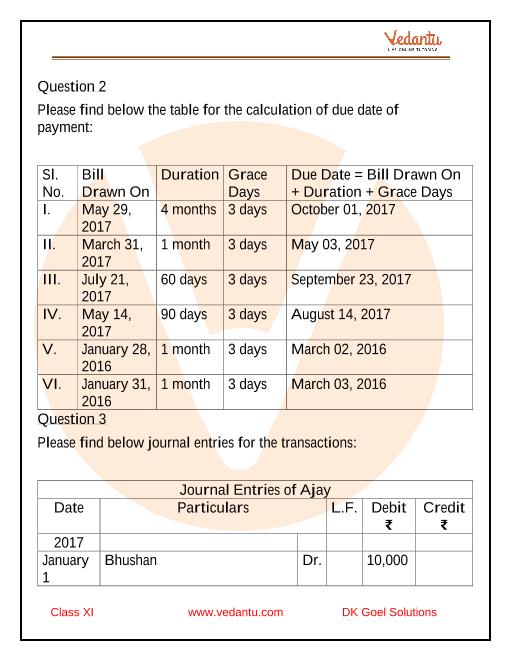

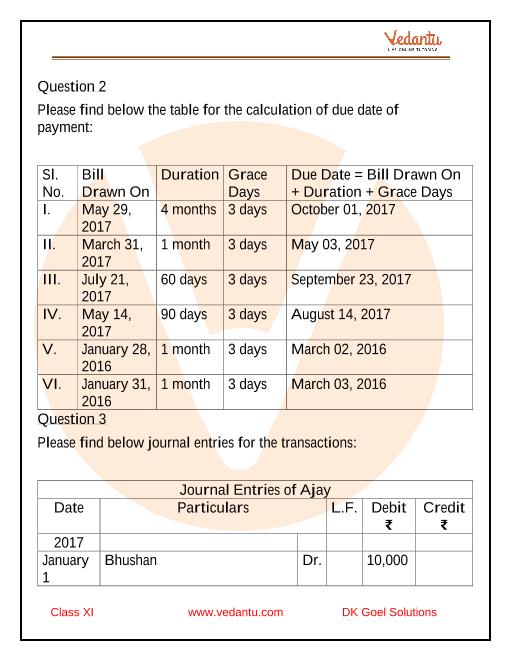

You can also purchase only the requested tools with a basket system. ADVERTISEMENTS: Such an equated date of payment is called the Average Due Date. Banknotes are common forms of promissory notes. If there is a payment which is due in more than 90 days, it is not included in the proposal. Term of the Bill was 20 days. It is also available ont the site: after you log on the site with your email address and your password, click on your name at the top right of the site. Here, we should remember, that there is a difference between one month or 30 days, when 30 days are given, we have to count 3 days above 30 days and where one month is given, we count 3 days of grace over a month as it is illustrated in the above example, where one month end on 15 April and date of maturity is 18 April inspite of 17 April.

Due Date Calculator

To calculate this date, additional three days are added as a period of grace. But how come due date limits I put in F110 are ignored? The bill of exchange was an acknowledgment created by Car Supply XYZ, which was also the A check always involves a bank while a bill of exchange can involve anyone, including a bank. This example shows how bill of exchange can be transferred from one party to another. A bill of exchange issued by a bank is referred to as a bank draft. One possible complication of allowing the pregnancy to proceed beyond 42 weeks is that the placenta, which is responsible for providing nutrition and oxygen to the baby, can stop functioning properly, while the baby continues growing requiring more nutrients and oxygen , which would eventually lead to a point in the pregnancy where the baby can no longer be adequately supported. Term of the Bill was 4 months.

Invoices due dates per payment term

Parties to Bills of Exchange In any bill of exchange, a maximum of three parties can participate. Now, if David retained the bill for the two months and receives the full amount on the due date, then David is the payee. Illustration 2: Kumar, a partner in a firm has drawn the following amounts for the half year ended 30th June 2004: Second Method: Procedure for calculation of Average Due Date when lending in lump sum but repayment in installments, is as follows: 1. The basic day is the lending date. Therefore, April 1 9 will be the date of maturity for this bill.