Cadbury was a British multinational confectionery company founded in 1824. It was known for producing chocolate, as well as other confectionery products such as candy, gum, and sweets. In 2010, Cadbury was acquired by the American multinational food and beverage company, Kraft Foods. This acquisition was controversial, as it was seen by some as a foreign takeover of a beloved British brand.

One of the main reasons for the acquisition was the potential for cost savings. By acquiring Cadbury, Kraft was able to eliminate duplicative functions and streamline its operations. This meant that Kraft could produce Cadbury's products more efficiently, which could lead to lower prices for consumers. Additionally, Kraft hoped to leverage Cadbury's strong brand and distribution network to expand its presence in international markets.

However, not everyone was in favor of the acquisition. Some argued that it would lead to job losses in the UK, as Kraft planned to close several of Cadbury's factories. There were also concerns about Kraft's track record, as the company had a reputation for cutting costs by reducing investment in research and development and cutting jobs.

Despite these concerns, the acquisition went ahead and Cadbury became a subsidiary of Kraft. In the years following the acquisition, Kraft made several changes to Cadbury's operations. It closed several of Cadbury's factories and laid off thousands of workers. These moves were met with criticism from some quarters, as they were seen as an example of Kraft prioritizing cost cutting over the welfare of its employees.

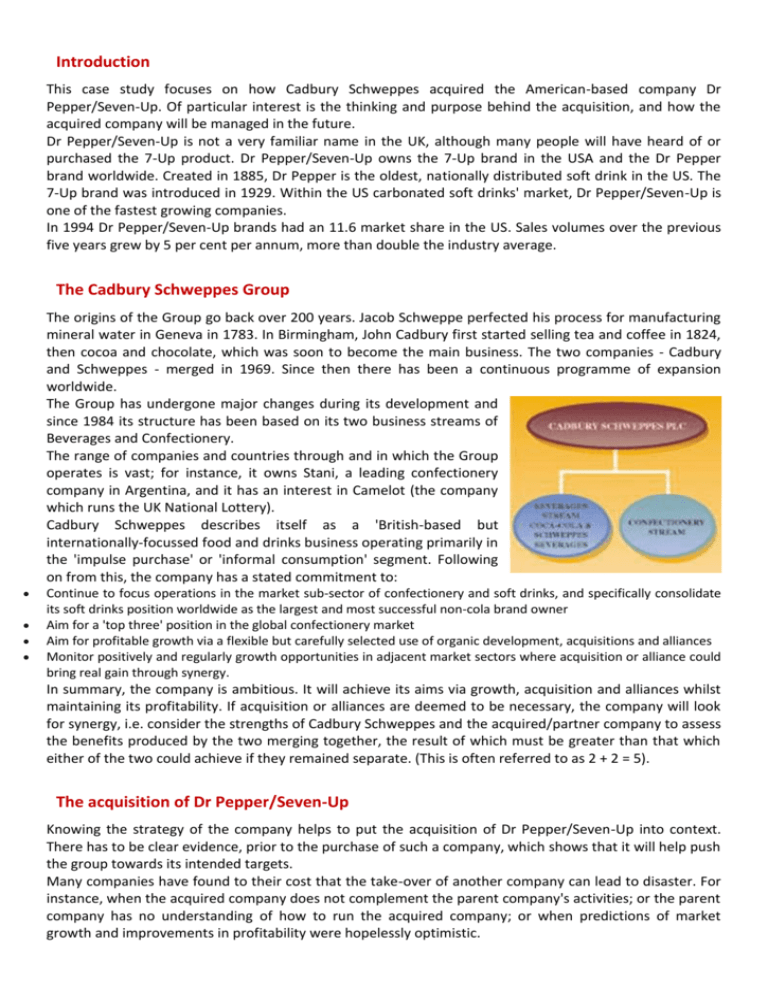

Overall, the Cadbury acquisition was a controversial event that had both supporters and detractors. While it may have led to cost savings and helped Kraft expand its international presence, it also resulted in job losses and disrupted the operations of a beloved British brand.