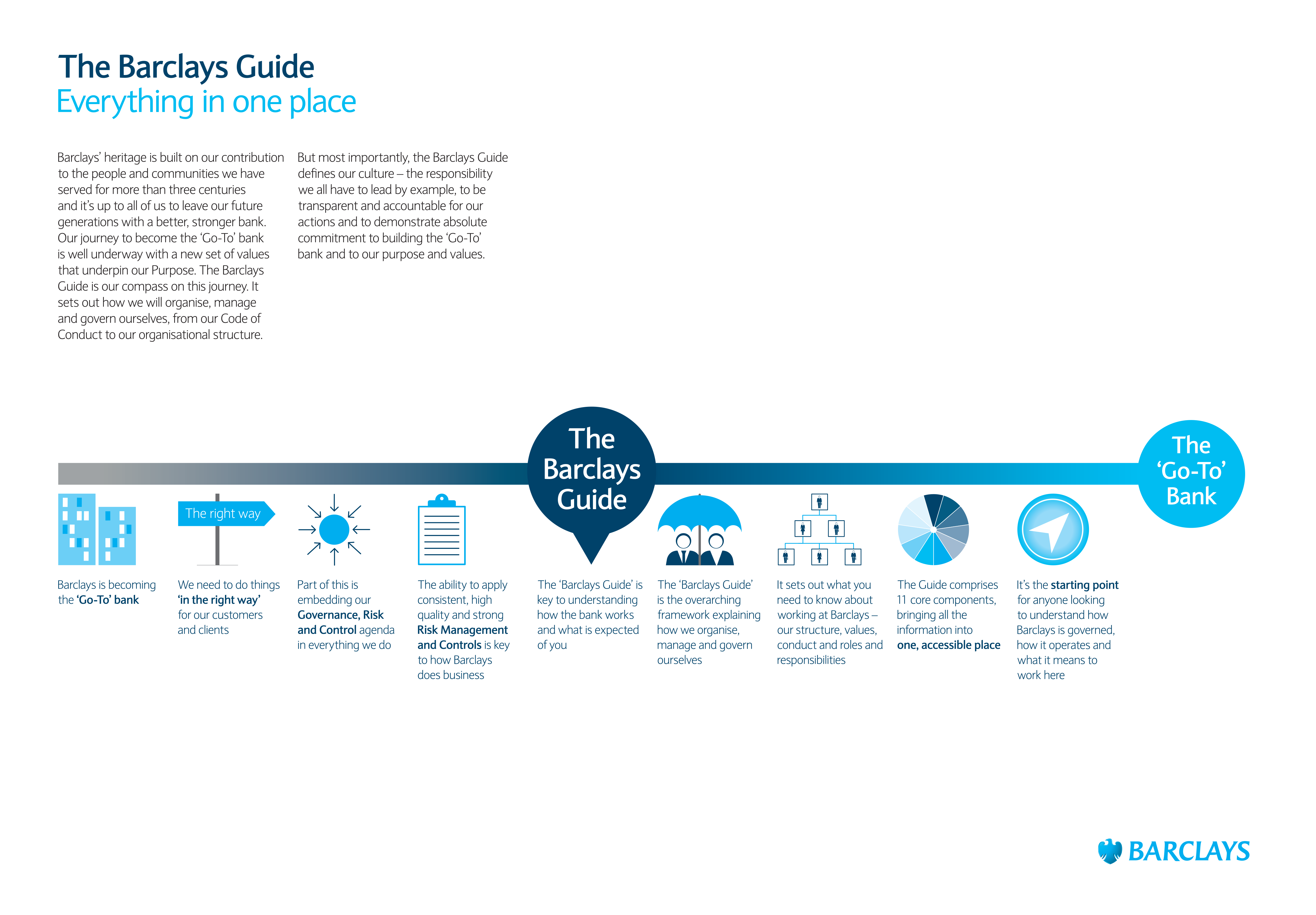

Barclays is a multinational investment bank and financial services company headquartered in London, United Kingdom. The company has a complex management structure that includes a board of directors, executive committee, and various business divisions and units.

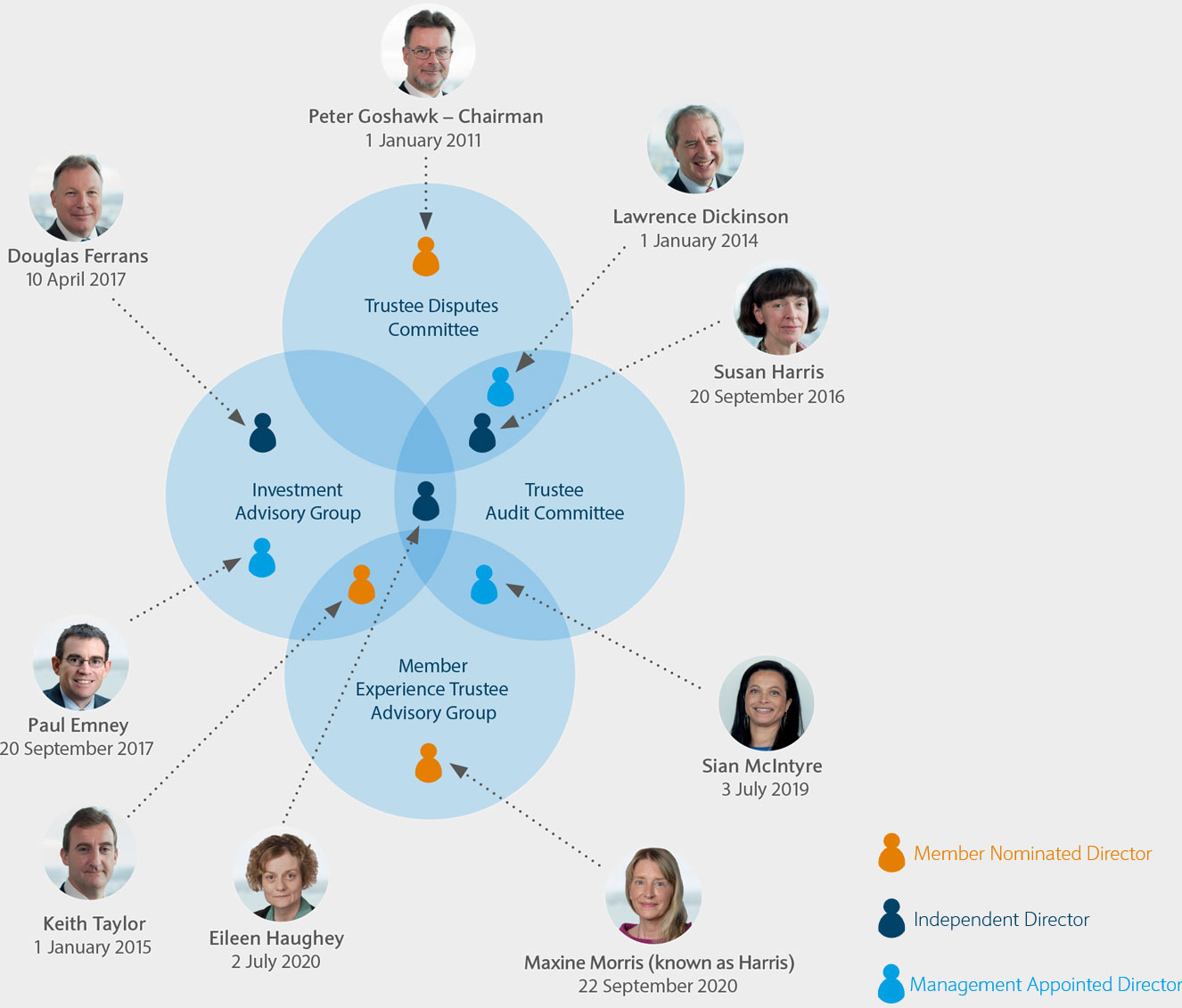

The board of directors is responsible for the overall direction and supervision of the company. It is composed of non-executive directors and executive directors, with the latter also serving on the executive committee. The board sets the company's strategic goals and approves major business decisions.

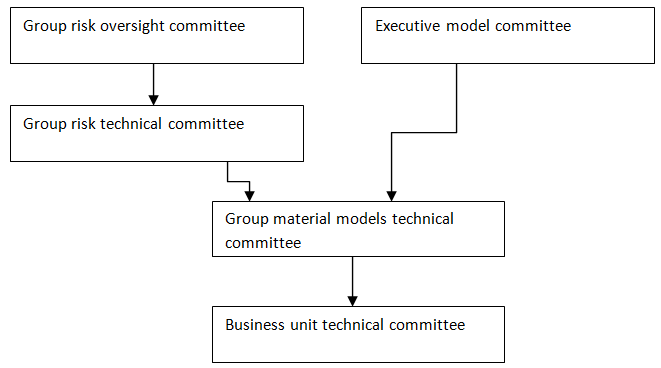

The executive committee is responsible for the day-to-day management of the company. It is composed of the CEO and other senior executives who report directly to the CEO. The executive committee is responsible for implementing the strategies and policies set by the board of directors and for managing the various business divisions and units of the company.

Barclays is organized into four main business divisions: Corporate and Investment Banking, Wealth and Investment Management, Barclays International, and Personal and Corporate Banking. Each division is further divided into various units and teams that focus on specific products and services.

The Corporate and Investment Banking division provides a range of financial products and services to corporate clients, financial institutions, and governments. It is divided into four main units: Corporate Finance, Markets, Investment Banking, and Research.

The Wealth and Investment Management division provides wealth management, investment management, and brokerage services to retail and institutional clients. It is divided into three main units: Wealth and Investment Management, Barclays Private Bank, and Barclays Wealth.

Barclays International provides a range of financial products and services to clients in Europe, the Americas, and Asia. It is divided into four main units: Barclays Bank PLC, Barclays Bank UK PLC, Barclays Bank Ireland PLC, and Barclays Bank Delaware.

The Personal and Corporate Banking division provides a range of financial products and services to retail and small business customers in the UK and Europe. It is divided into three main units: Retail Banking, Credit Cards, and Small Business Banking.

In conclusion, the management structure of Barclays is complex and hierarchical, with a board of directors and executive committee overseeing the various business divisions and units. Each division and unit is responsible for specific products and services, and works together to achieve the overall goals and objectives of the company.