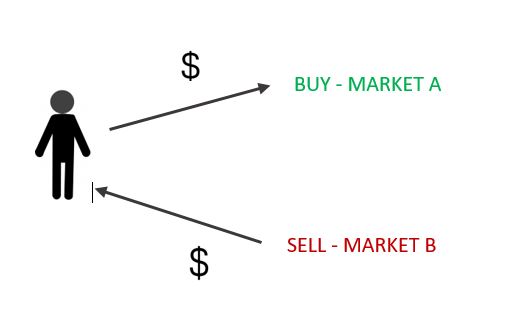

Arbitrage is the practice of taking advantage of price differences in different markets or between different assets. It involves buying an asset in one market and selling it in another market or against another asset in order to profit from the price difference. The goal of arbitrage is to exploit market inefficiencies and make a profit without assuming any risk.

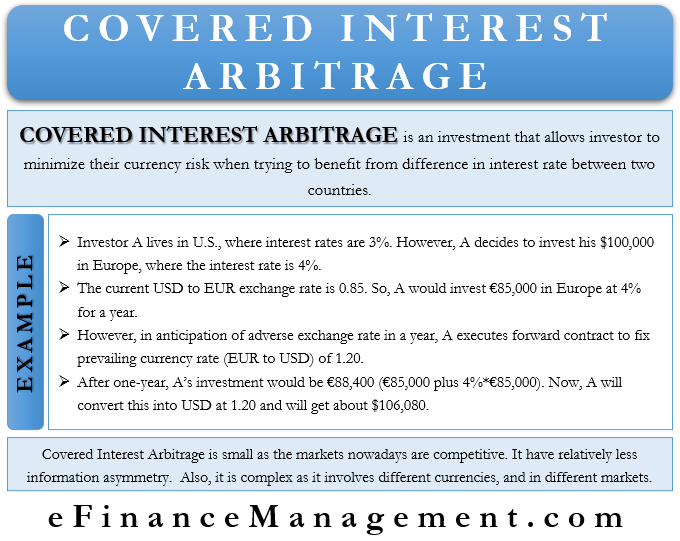

There are several different types of arbitrage, including triangular arbitrage, statistical arbitrage, and risk arbitrage. Triangular arbitrage involves taking advantage of discrepancies in exchange rates between three different currencies. For example, if the exchange rate between the US dollar, the British pound, and the European euro is such that it is possible to convert US dollars to British pounds, convert the British pounds to euros, and then convert the euros back to US dollars at a higher exchange rate than the original, then an arbitrage opportunity exists.

Statistical arbitrage involves using statistical models and algorithms to identify and exploit price discrepancies in financial markets. This type of arbitrage often involves high-frequency trading, where trades are executed at a rapid pace in order to take advantage of small price differences.

Risk arbitrage, also known as merger arbitrage, involves taking advantage of price discrepancies that arise due to the announcement of a merger or acquisition. When a company announces that it is acquiring another company, the stock price of the target company may rise due to the perceived value of the deal, while the stock price of the acquiring company may fall due to the cost of the acquisition. An arbitrageur may buy the stock of the target company and short sell the stock of the acquiring company, profiting from the price discrepancy between the two.

The arbitrage process can be complex and requires a deep understanding of financial markets and the assets being traded. It also requires the ability to identify and act on opportunities quickly, as prices can change rapidly in financial markets. As a result, arbitrage is often carried out by professional investors or specialized arbitrage firms.

Overall, arbitrage is a way to profit from discrepancies in the market and can be a useful strategy for investors looking to maximize their returns without assuming additional risk. However, it is important to understand the risks and complexities involved in the arbitrage process before attempting to engage in it.