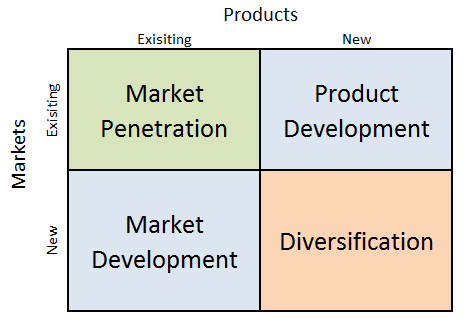

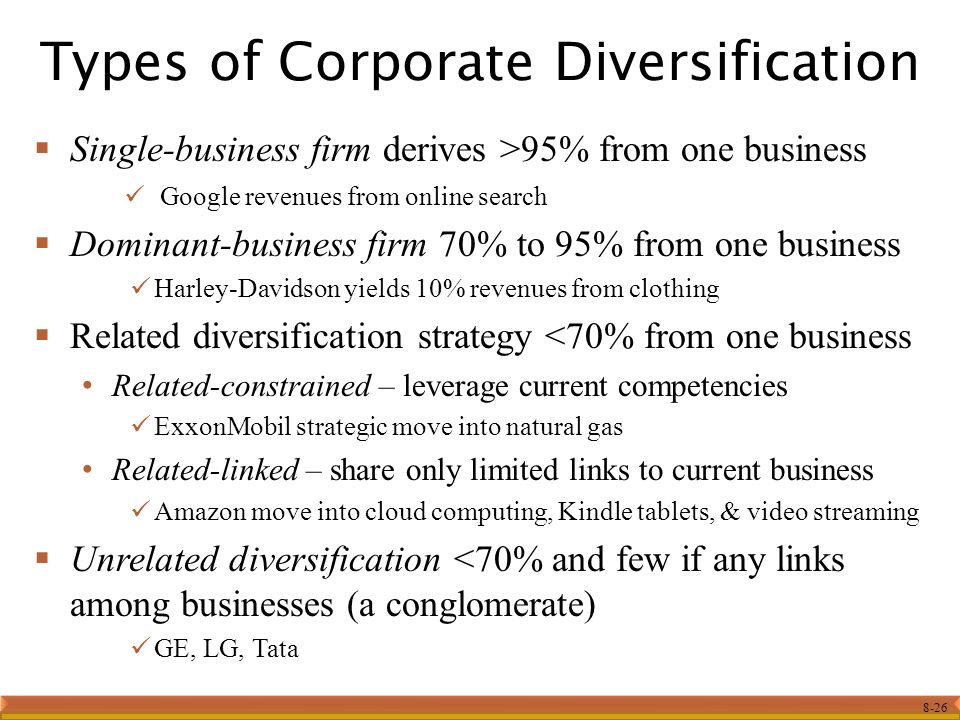

Amazon is a company that has consistently pursued a strategy of unrelated diversification in order to expand its business and increase its profits. Unrelated diversification is a type of corporate strategy in which a company expands into new markets or industries that are unrelated to its core business. This can be a risky strategy, as it requires a company to enter markets in which it has little or no experience, but it can also be a lucrative way to diversify a company's income streams and mitigate risks.

One of the key ways that Amazon has pursued unrelated diversification is through acquisitions. Over the years, Amazon has made a number of acquisitions of companies in industries that are unrelated to its core business of online retail. For example, in 2014, Amazon acquired the video game streaming platform Twitch for $970 million. This was a significant departure from Amazon's core business, but it allowed the company to enter the growing market for online gaming and video streaming.

Another way that Amazon has pursued unrelated diversification is by developing new products and services that are unrelated to its core business. For example, Amazon has launched a number of successful ventures in the fields of cloud computing, artificial intelligence, and healthcare. These ventures have allowed Amazon to diversify its income streams and position itself as a leader in emerging technology markets.

One of the key advantages of unrelated diversification is that it allows a company to enter new markets and industries that may offer significant growth opportunities. By diversifying its income streams, a company can reduce its reliance on any one market or industry and become more resilient to economic downturns or other risks. In the case of Amazon, unrelated diversification has allowed the company to grow and expand into new areas, increasing its profitability and market presence.

However, unrelated diversification can also be a risky strategy, as it requires a company to enter markets in which it has little or no experience. This can be a challenge, as a company may not have the necessary expertise or resources to successfully navigate these new markets. In addition, unrelated diversification can also be expensive, as it requires a company to invest in new technology, research and development, and marketing efforts.

Despite these risks, Amazon has consistently pursued a strategy of unrelated diversification and has been successful in expanding its business into new areas. By carefully evaluating opportunities and investing in the right ventures, Amazon has been able to diversify its income streams and become a leader in a number of industries. As the company continues to grow and expand, it is likely that unrelated diversification will remain an important part of its strategy.