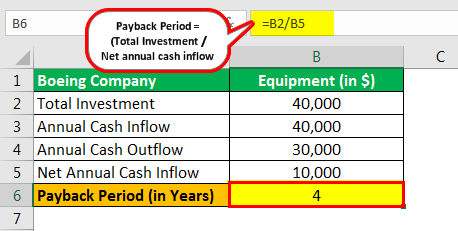

Discounted cash flow (DCF) is a financial analysis method that is used to determine the present value of a future stream of cash flows. The idea behind DCF is that the value of money decreases over time due to inflation, and therefore, a dollar received in the future is worth less than a dollar received today. By discounting the future cash flows, we can determine the present value of those cash flows, which is a more accurate representation of their worth in today's terms.

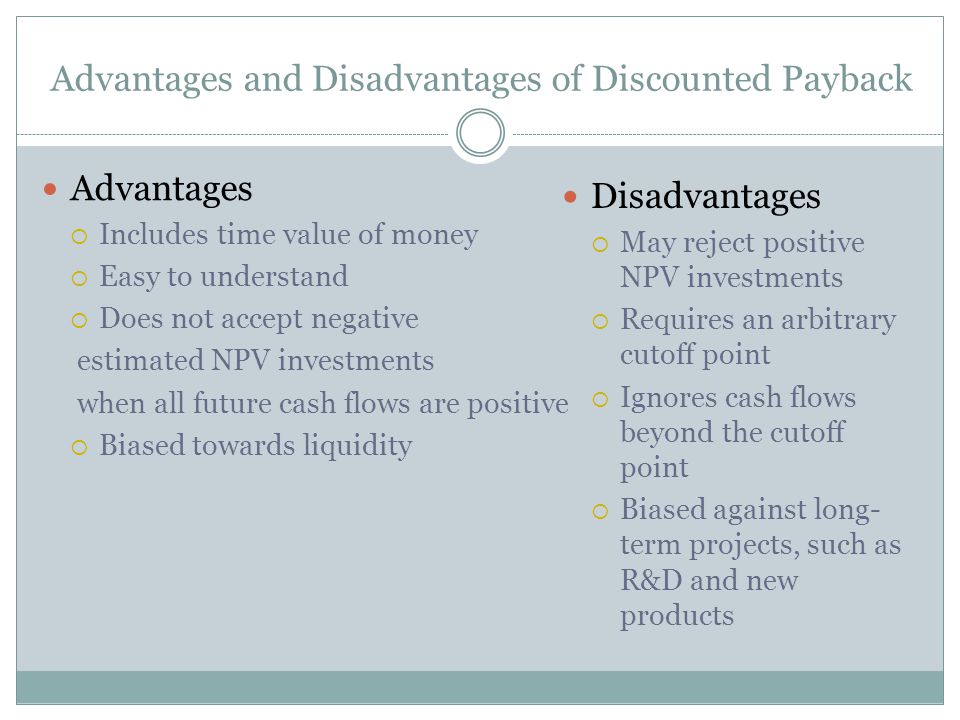

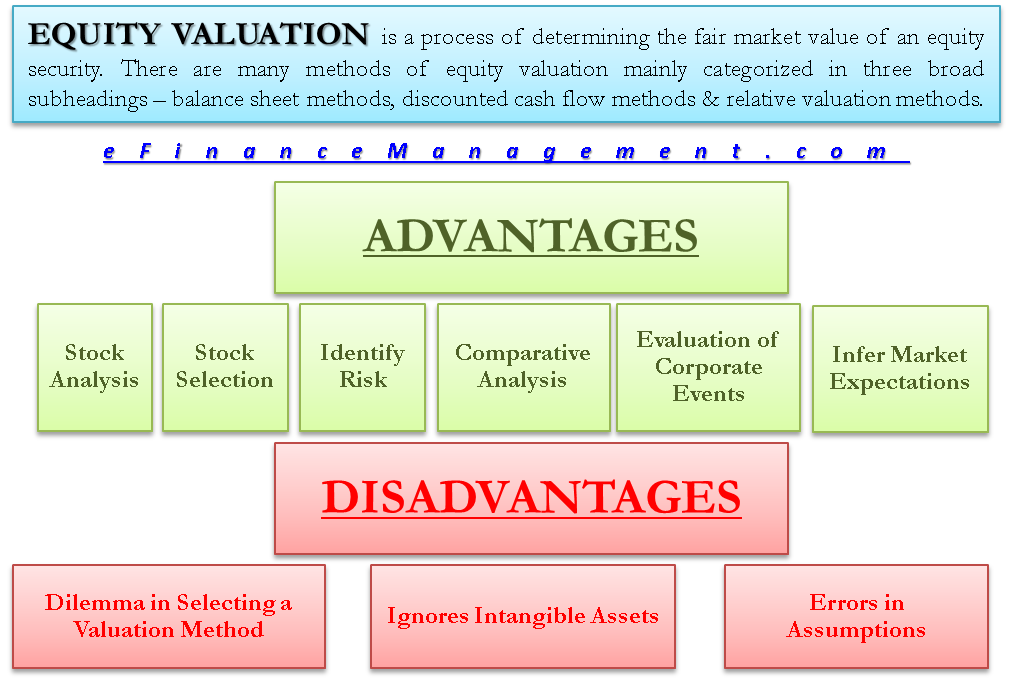

There are several advantages to using discounted cash flow analysis. One of the main advantages is that it allows us to compare investments with different expected cash flows and different time horizons. For example, if we are considering two different investment opportunities, one with a shorter time horizon and one with a longer time horizon, we can use DCF to determine the present value of each investment and compare them on an apples-to-apples basis. This can help us make more informed investment decisions.

Another advantage of DCF is that it takes into account the time value of money, which is the idea that money is worth more today than it is in the future. By discounting future cash flows, we can account for the fact that money is worth less in the future due to inflation. This is important because it helps us to determine the true value of an investment, rather than just looking at the raw cash flows.

However, there are also some disadvantages to using discounted cash flow analysis. One of the main disadvantages is that it requires us to make a number of assumptions about the future, such as the discount rate, the expected cash flows, and the length of the investment period. These assumptions can be difficult to make with accuracy, and if our assumptions are incorrect, it can lead to inaccurate valuation results.

Another disadvantage of DCF is that it does not take into account non-monetary factors, such as the risk associated with the investment or the potential for future growth. This can make it difficult to accurately value certain types of investments, such as startups or other high-risk ventures.

In conclusion, discounted cash flow analysis is a useful tool for determining the present value of a future stream of cash flows. However, it is important to be aware of its limitations and to carefully consider the assumptions that go into the analysis.